ニュース What is US withholding tax?. トピックに関する記事 – What is the withholding tax in the USA

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

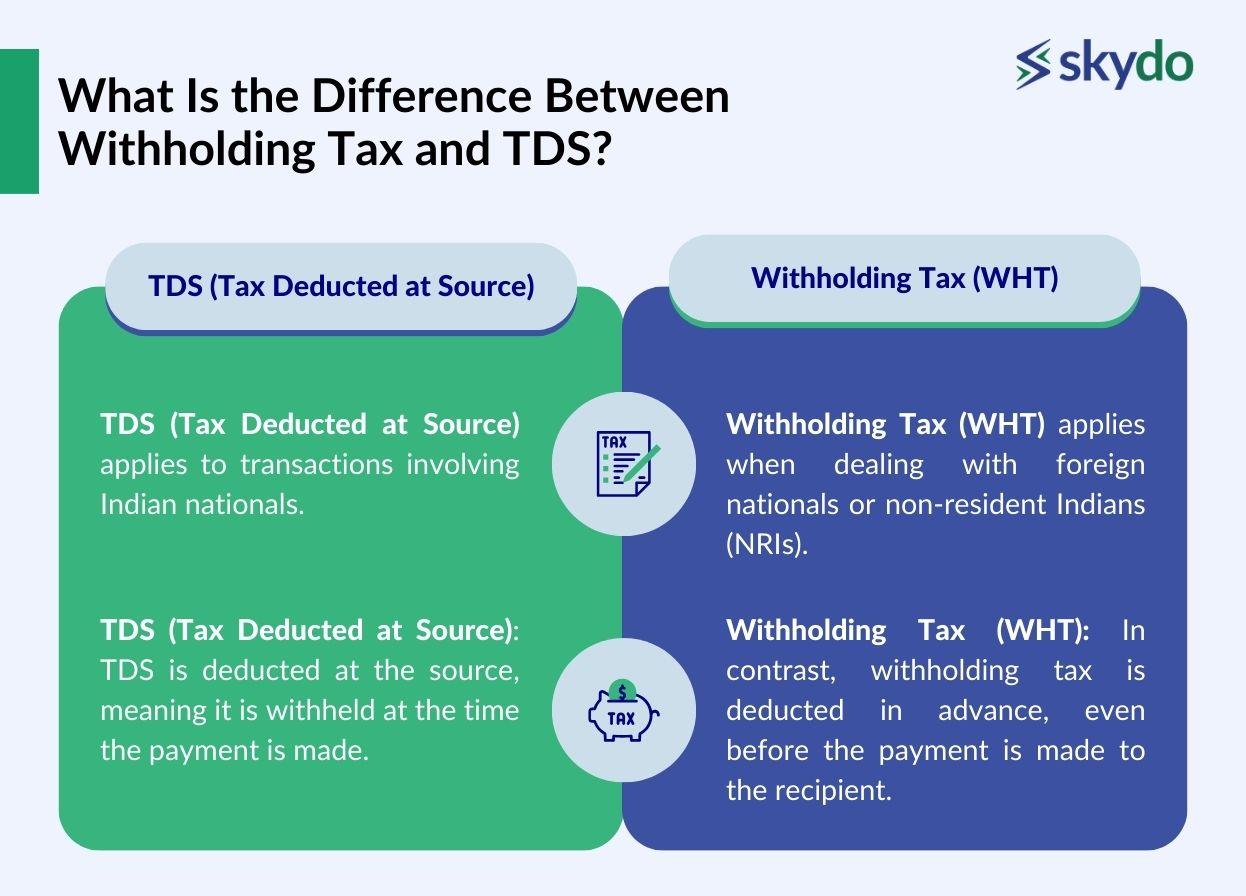

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4.U.S.: 30% (for nonresidents)Under this method, the payers of certain types of income are required to withhold a portion of the income payment on the date of payment as a withholding tax. Eventually, the amount withheld shall be remitted to the Japanese tax authorities.

What is a tax withholding slipA withholding tax statement is an official document that shows your total salary in a year (from January 1st to December 31st). The company where you are working at will issue and provide the document to you.

How do I get my US withholding tax back

Here are the basic steps you'll need to take to claim back withholding taxes: File a US Tax Return: You'll need to file a US tax return, even if you don't owe any taxes to the US government. This will include Form 1040NR, which is the tax return for non-resident aliens.Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if an Internal Revenue Code Section provides for a lower rate, or there is a tax treaty between the foreign person's country of residence and the United States.

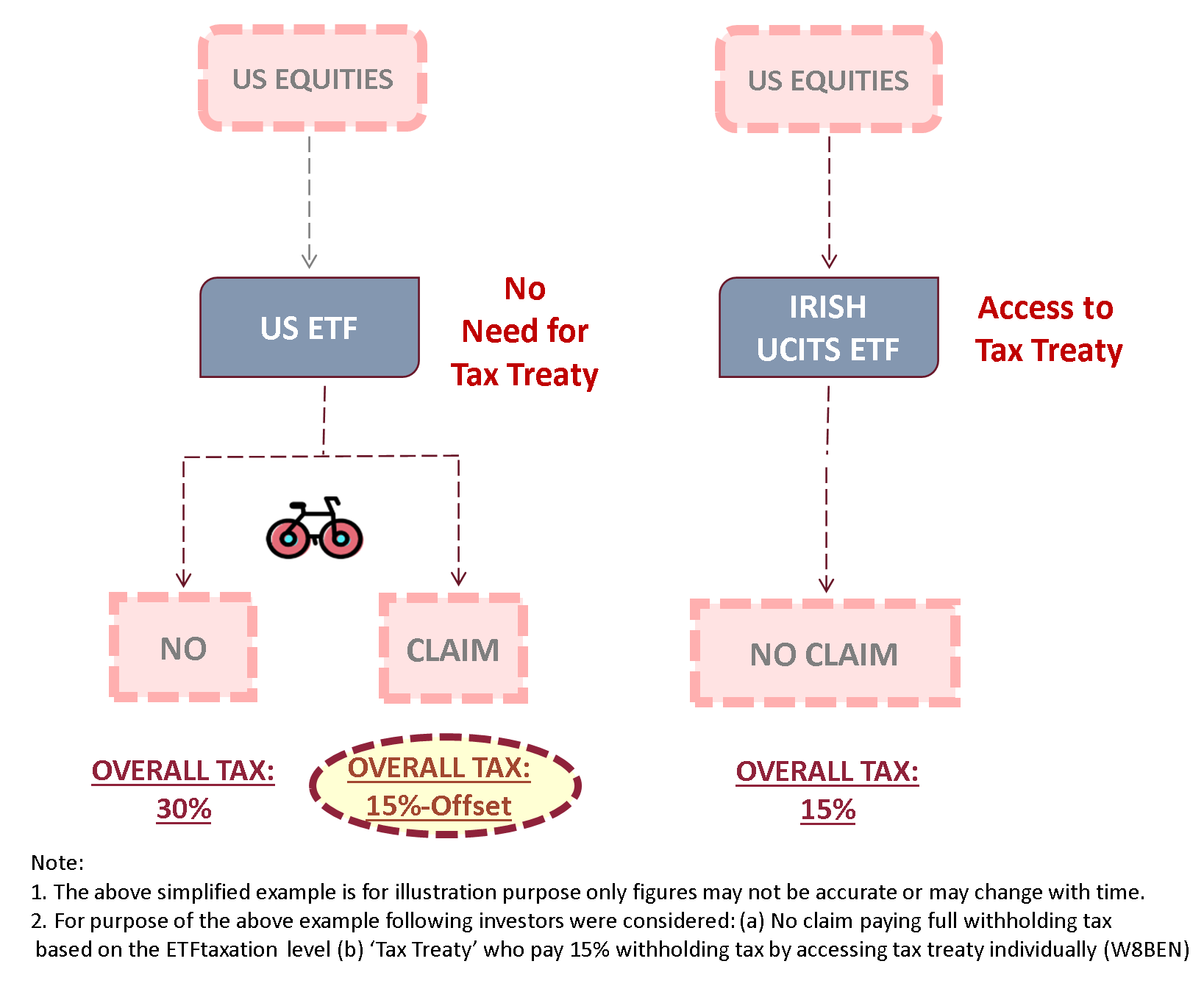

Is there 15% withholding tax on US dividends

Under the Treaty, a 15% withholding tax generally applies to U.S. dividends you receive from U.S. corporations. This will generally apply to dividends you receive on U.S. common and preferred shares.

The United States and Japan entered into a bilateral international income tax treaty several years ago. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and residents of either country on matters involving cross-border income.

What is the tax treaty between Japan and the US

US-Japan Income Tax Treaty is a bilateral agreement between the US and Japan that aims to eliminate double taxation and prevent tax evasion on income earned by individuals and businesses in both countries.Where can I obtain the Gensen Choshu-hyo (tax withholding slip) The Gensen Choshu-hyo, stating the income tax deducted from your salary, is issued by the company you work for. Please inquire your company for this statement.Taxation is based on the calendar year, so employment income is ultimately taxed at the same rate regardless of whether it is paid as salary or bonus.

In general, the U.S. tax treatie provide for a reduced withholding tax rate of 15% on dividend income.

Are US lottery winnings taxableYou must pay federal income tax if you win

If the bounty is spread out over 30 years, you may not be in the highest tax bracket each year, depending on the size of your prize and your other income. All winnings over $5,000 are subject to tax withholding by lottery agencies at the rate of 24%.

Who is exempt from US withholding taxTo be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Can I claim back US withholding tax on dividends

If you reside in a country that has an income tax treaty with the country that taxed the dividend, and said treaty provides a lower tax rate when compared to the tax rate imposed on the dividend you received, you should be eligible for a refund of the excess tax withheld.

Under the Treaty, a 15% withholding tax generally applies to U.S. dividends you receive from U.S. corporations. Certain types of corporate actions (i.e., takeovers, mergers, spin-offs, etc.) involving shares in the U.S. and other foreign corporations may be considered to be non-taxable for Canadian tax purposes.The agreement contained five articles, which dictated that Japan allow the United States to continue maintaining military bases on Japanese soil even after the end of the Occupation. The accord prohibited Japan from providing foreign powers any bases or military-related rights without the consent of the United States.Non-Resident Aliens

Treaties are only applicable to Non-Resident Aliens for tax purposes. To claim a tax treaty exemption, you must submit IRS Form 8233 to your employer prior to starting your employment and at the beginning of each new tax year.