ニュース What is duty a tax on imported goods?. トピックに関する記事 – What is a duty on an import

A tariff or duty (the words are used interchangeably) is a tax levied by governments on the value including freight and insurance of imported products. Different tariffs applied on different products by different countries.Types of custom duty in India

| Type of custom duty | Rate |

|---|---|

| Countervailing Duty (CVD) | 0% to 12% depending on the product |

| Special Additional Duty (SAD) | 4% where applied |

| Social Welfare Surcharge (SWS) | 10% where applied |

| Safeguard Duty | By notification |

Simple average applied Most Favored Nation (MFN) tariff for Japan, according to the WTO data, is as follows: All products — 4.3 percent. Agriculture products — 15.5 percent. Non-agriculture — 2.5 percent.

How much is import tax from ChinaHow does the UK charge import duty on China goods

| Type and value of goods | Import duty rate |

|---|---|

| Any goods under £135 | No charge |

| Gifts worth £135-£630 | 2.5% (lower for some goods) |

| Gifts above £630 and any other goods above £135 | Depends on the type of goods and country of export. Check the HS code of goods to get the exact rate. |

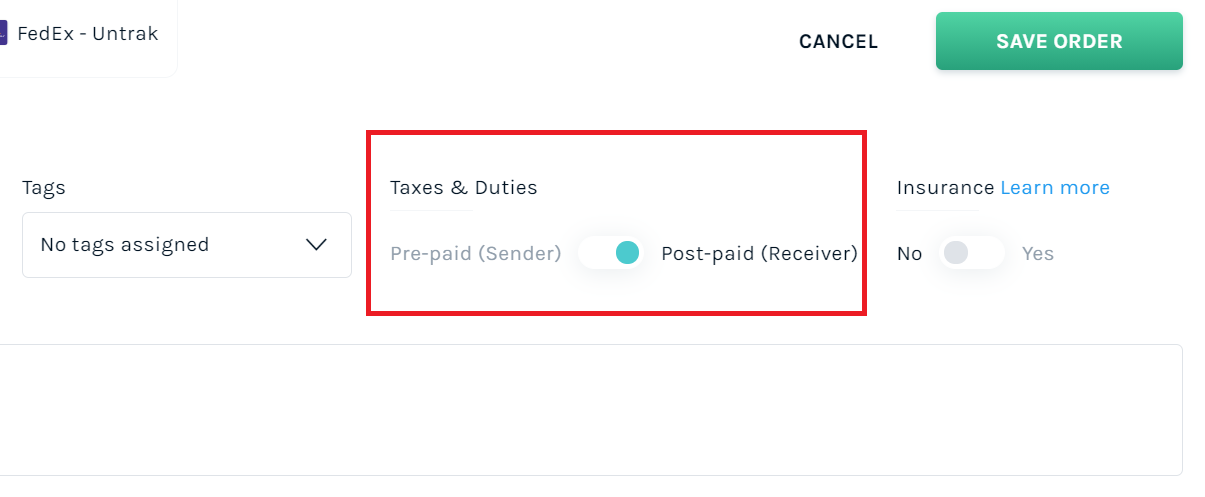

Who pays for import duties

The importer

Importing Process Paying Duty: The importer is ultimately responsible for paying any duty owed on an import. Determining duty can be very complicated, and while shipping services will often give an estimate for what the duty rate on an item might be, only CBP can make a final determination about what is owed.Nominated Banks for Customs Commissionerates (For payment of duty)

- Ahmedabad I. Bank of Baroda.

- Amritsar. Punjab National Bank.

- Bangalore. State Bank of India.

- Calcutta (Port) * United Bank of India.

- Calcutta (Airport & Air Cargo)* State Bank of India.

- Calcutta (Prev)

- Chennai (Port)*

- Chennai (Airport & Air Cargo)*

How do you calculate import duty rate

The U.S. International Trade Commission-Tariff Database, is an interactive data base that will enable you to get an approximate idea of the duty rate for a particular product.

With the prospect of increased tariffs looming, World Finance lists the countries that impose the highest charges on imported goods.

- 1 – The Bahamas (18.56%)

- 2 – Gabon (16.93%)

- 3 – Chad (16.36%)

- 4 – Bermuda (15.39%)

- 5 – Central African Republic (14.51%)

Do I pay import duty on goods from Japan

If you need to pay import duty on goods from Japan, you'll be contacted by Royal Mail (or your courier) and told how to pay. You'll usually have 3 weeks to pay any charges, before they send parcel back. As your parcel will be from outside the EU, you may be charged VAT or excise duty on it.Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles.There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.Usually there would be duty costs when importing goods from China, India, Taiwan and the USA but there are some cases where Duty and VAT relief is granted. Duty and VAT relief can be granted on sample of a product if: Once imported they can only be used as sample products.

You must pay the required rate of duty and VAT, as stated with the commodity code. Check if there are any duty reliefs. If payment isn't made, your goods could end up getting held up in customs causing delays and unexpected costs. The duty is paid on the cost of the goods and the shipping costs.

Do I have to pay customs for package from Japan to usDepending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.

How much is import tax on a watch from JapanThis, plus usually about £15 handling fee by the courier. I think for a watch, you should times it by 1.24 to get a rough idea. 20% VAT and around 4% import duty. This is for the whole cost so include the delivery cost too in your calculations.

Who pays import customs

Common examples include anti-dumping taxes, trade tariffs, export duties and excise duties. They're mostly in the form of import duties, which apply to goods entering a country. Who pays duties Most duties are paid by the importer.

In case of goods imported from abroad, import duty, customs duty or dock charges etc. have to paid. Since these are related to purchase of goods for resale purposes, these expenses are shown in the debit side of the Trading Account.Since the beginning of 2019, certain goods imported from Japan benefit from an exception or a reduction of applicable TARIFF (customs duty). Details are complicated and those new measures will be gradually released over a period of 7 years, but it doesn't change much for you. Most of our goods are taxed at about 3%.The United States is the world's largest importer of goods, followed by China and Germany. Overall out of the world's 10 largest importers, 4 countries are in Europe, 4 are in Asia and 1 from North America and 1 from Central America. NO.