ニュース What is an example of delivery duty paid?. トピックに関する記事 – What is duty paid value

:max_bytes(150000):strip_icc()/Term-Definitions_delivery-duty-paid-f7943b12b1b343faaf4f5bf7fef43f15.jpg)

duty paid value means the value of the article as it would be determined for the purpose of calculating an ad valorem duty on the importation of that article into Canada under the laws relating to the customs and the Customs Tariff whether that article is in fact subject to ad valorem or other duty or not, plus the …If a corporation meets certain conditions, such as keeping certain accounting books, and makes an application for it in advance, it is allowed to file a 'blue form' tax return. A 'blue form' filing corporation may benefit from loss carryforward and other benefits, including access to incentives.Blue return filers who are engaged in business that generates real estate income or business income shall, in principle, receive a deduction of up to 550,000 yen(blue return filers who keep book by electronic book keeping of who has filed the final tax return by e-Tax receive a deduction up to 650,000 yen) through such …

What is Japanese consumption taxMain points. The Consumption tax rate in Japan is 10%, except for food stuffs which is 8% It has to be collected and paid between businesses (B2B transactions) Qualified invoices need to be used in transactions, specifying CT. The amount paid during B2B transactions is compensated by the amount collected during sales.

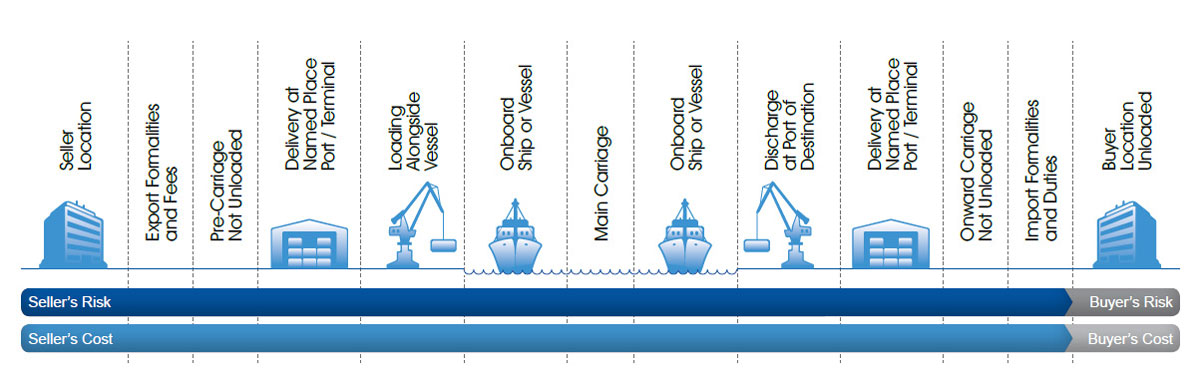

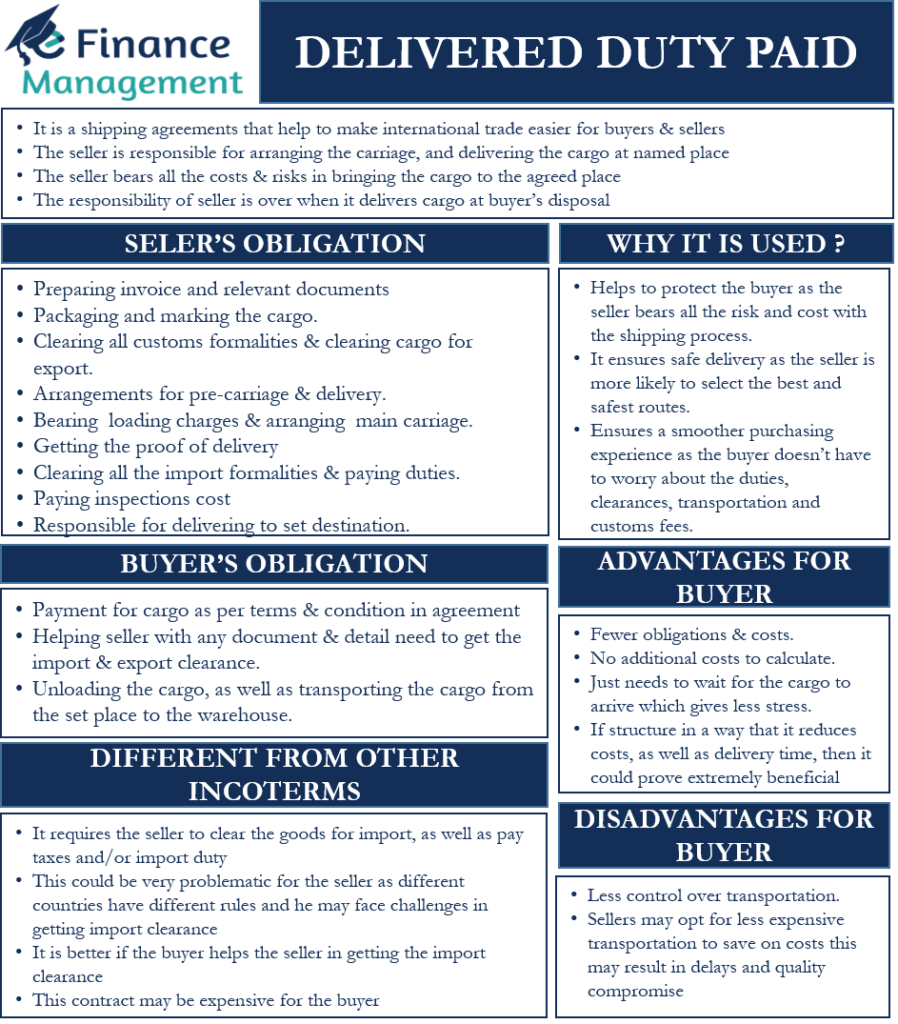

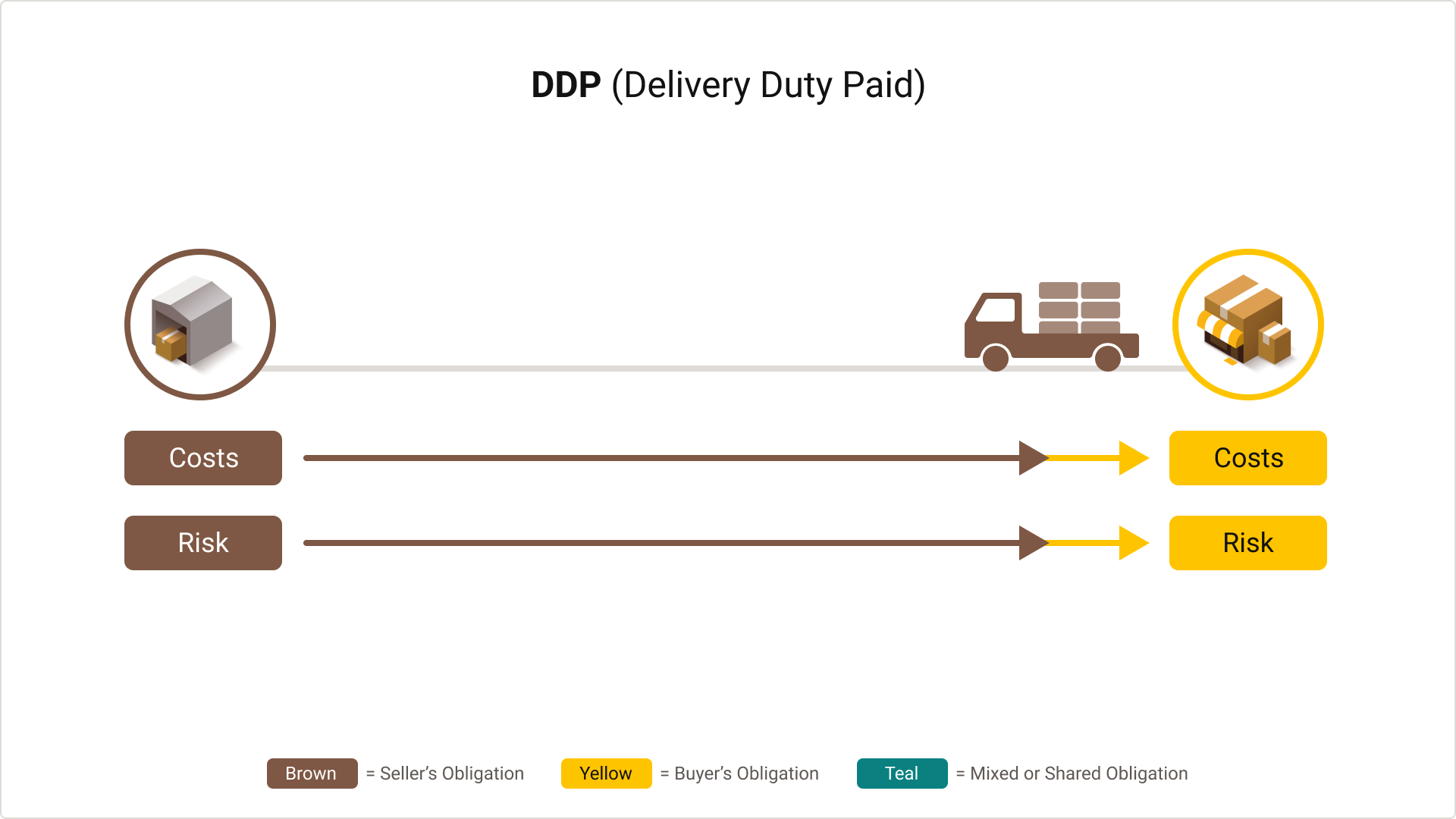

What is delivered duty paid cost

The term Delivered Duty Paid (DDP) is used in international trade to describe a deal wherein the seller of goods agrees to bear all costs until the goods reach the destination mutually agreed upon in the contract.When a seller quotes a price and includes the Incoterm abbreviation, DDP, it means the cost of the goods is including the delivery and duty charges. Seller's responsibilities go beyond the delivery of final goods and include: Drawing up sales contracts and related documents.

What taxes are paid in Japan

Taxes

- Income Tax. Paid annually by individuals on the national, prefectural and municipal levels.

- Enterprise Tax. Prefectural tax paid annually by self-employed individuals engaged in business activities.

- Property Tax.

- Consumption Tax.

- Vehicle related Taxes.

- Liquor, Tobacco and Gasoline Taxes.

The statistic shows the highest tax rate in Japan from 2011 to 2021. In 2021, the highest tax rate in Japan was 55.97 percent.

What is blue tax return

The “blue tax return” system (named for the color of the tax form) was initiated following a recommendation by the Shoup Mission in 1950 in order to promote the use of modern accounting methods by taxpayers with conferring certain benefits on the “blue form” tax filers.Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles.There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.No. 10 Consumption Tax rate

| Classification | Applicable period | |

|---|---|---|

| Until September 30,2019 | From October 1,2019 | |

| National Consumption Tax rate | 6.3% | 7.8% |

| Local Consumption Tax rate | 1.7% (17/63 of the amount of National Consumption Tax) | 2.2% (22/78 of the amount of National Consumption Tax) |

| Total | 8.0% | 10.0% |

The Consumption Tax in Japan (also known as VAT, GST or sales tax in some countries) is 10% for all items excluding groceries, drinks, and newspaper subscriptions which are 8% (alcoholic drinks and ordering food at a restaurant for eating out are 10%).

What is the meaning of delivery dutyDelivery Duty Paid (DDP) Meaning: Delivery & Shipment Terms

DDP stands for “Delivered Duty Paid” which means that the seller delivers the goods when the goods are placed at the disposal of the buyer, cleared for import on the arriving means of transport, and ready for unloading at the named place of delivery.

What is the difference between delivered at place and delivered duty paidThe main difference between DDP and DAP is delivery to destination and who is responsible for import duty, taxes and security clearance. Under DDP, the seller assumes the maximum responsibility in costs and risk from the beginning to the end. Under DAP, the buyer bears the costs and taxes of import clearance.

What taxes do foreigners pay in Japan

Tax Rates in Japan for Non-Residents

A non-resident's Japan-sourced employment income (wages, salaries, annuities, etc.) is subject to a flat withholding tax rate of 20.42%, with no deductions available. This rate includes the 2.1% surtax rate.

Salary Range in Japan

In Japan, the average monthly salary for employees can span from approximately 130,000 JPY (958 USD) to 2,300,000 JPY (16,944 USD). It's crucial to note that the upper range of salaries signifies the highest average, not the maximum salary that Japanese individuals can earn.Do you tip in Japan The short answer: No. In some situations, trying to leave a tip may be even off-putting. As wild as that may seem to American travelers, Japanese culture prioritizes excellent service without any expectation to provide a financial tip as appreciation.Purchases that total 5,000 yen or more qualify for a tax refund. The terms and conditions of tax refunds depend on the type of product.