ニュース What is an example of an exemption?. トピックに関する記事 – What are considered exemptions

There are two types of exemptions-personal and dependency. Each exemption reduces the income subject to tax. The amount by which the income subject to tax is reduced for the taxpayer, spouse, and each dependent.Exemption, immunity, impunity imply special privilege or freedom from imposed requirements. Exemption implies release or privileged freedom from some duty, tax, etc.: exemption from military service.In finance and accounting, an exemption is generally regarded as the exclusion of a payment or any type of liability that is put in place by a legal authority. It is colloquially used to describe tax exemptions that people and businesses can utilize to reduce the amount owed to federal and local governments.

What is taxable income in JapanTax Rates. The tax rate is determined based on the taxable income. Like in other countries, taxable income is the total earnings minus a basic exemption, exemptions for dependents and various types of deductions, such as deductions for insurance premiums, medical expenses and business expenses of the self-employed.

What is the most exemptions you can claim

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.An exception is a situation that doesn't follow a rule, while an exemption is permission to not follow a rule. For example, if your bins are collected on Mondays but are collected on Tuesday this week, that's an exception. If you're exempt from buying a parking ticket, that's an exemption.

What is the difference between exemption and exemption

An 'exemption' is someone or something to which the general rule about anything does not apply, because they're 'exempt'. An 'exception' is a bit more irregular than an exemption. It's someone/something which – extraordinarily – may be exempted, rather than 'as of right'.

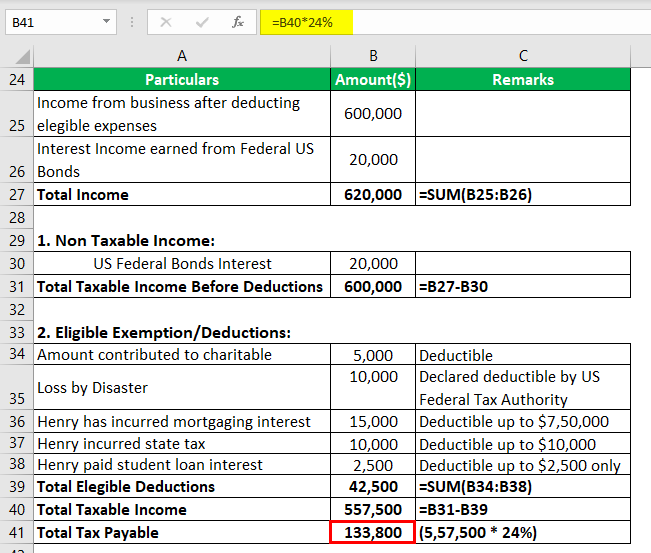

A tax exemption reduces or eliminates a portion of your income from taxation. Federal, state, and local governments create tax exemptions to benefit people, businesses, and other entities in special situations. Those who are entitled save on taxes by reducing their top-line income.

What is exemption and exclusion

“Exempted” means you are relieved or excused from an obligation. “Excluded” means you are prohibited from participating.Salary Range in Japan

In Japan, the average monthly salary for employees can span from approximately 130,000 JPY (958 USD) to 2,300,000 JPY (16,944 USD). It's crucial to note that the upper range of salaries signifies the highest average, not the maximum salary that Japanese individuals can earn.¥5,000

Tax free purchases apply to total purchase amounts of ¥5,000 or more (excluding tax/after discount has been applied), or¥5,500 (including tax). ・The items purchased must be put in a dedicated bag.

Exemption Rules and Limits under the Income Tax Act

According to the Finance Act of 2014, taxable income eligible for complete tax exemption has been increased in its limits, from the earlier Rs. 200000 to Rs. 250000. It should be kept in mind that these exemptions are allowed for salaried individuals only.

What is the most dependents you can claimAlthough there are limits to specific dependent credits, there's no maximum number of dependent exemptions you can claim. If a person meets the requirements for a qualifying child or relative, you can claim him or her as a dependent. You can do this as a single filer and regardless of your filing status.

Should you claim exemptionYou can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

What does it mean to do something without exemption

phrase. You use without exception to emphasize that the statement you are making is true in all cases. [emphasis] The vehicles are without exception old, rusty and dented.

Some taxpayers may file both exemptions and credits on certain tax returns. Both are generally favorable for the taxpayer, but each has a different mechanism to benefit the filer. Tax exemptions reduce the amount of income on which you owe tax.An exemption refers to the deduction allowed by the law to reduce the amount of income that would otherwise be taxed. It is a legal deduction from the income that would otherwise be taxed for a qualifying reason.without special permission not to do or pay something, especially tax: In the event of bankruptcy, your non-exempt assets are liquidated to mitigate your debts. Non-exempt competitors must successfully complete a qualifying round in order to take part in the finals. Fewer examples.