ニュース What are examples of tariffs on imports?. トピックに関する記事 – What is an example of a tariff

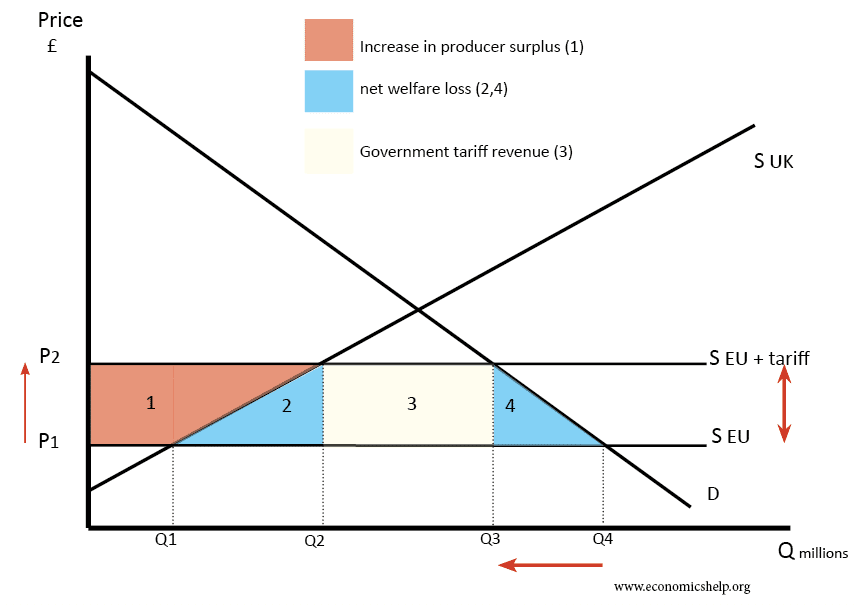

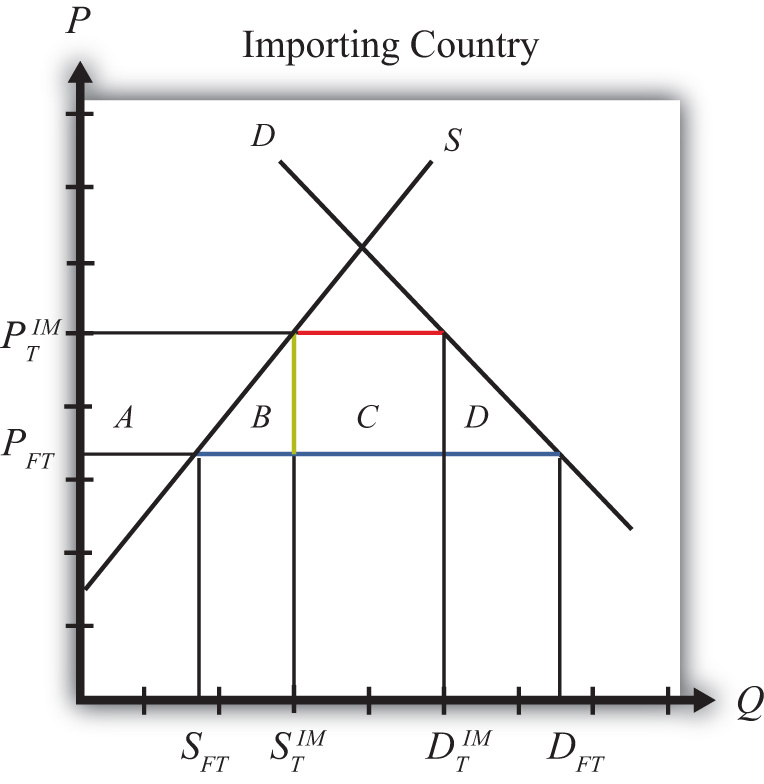

An example of a tariff would be a tax on a good imported from another country. For example, a 3% tariff on corn would be a 3% tax added to the cost of corn paid by any domestic importer of corn from a foreign country.The four types of tariffs are ad valorem tariffs, specific tariffs, compound tariffs, and mixed tariffs. A positive effect of a tariff is that it benefits domestic producers by keeping domestic prices high.An import tariff is a tax imposed on imported goods and services. Different rates of duty are applicable to different goods or commodities.

What is an example of a tariff in the UKMost tariffs are expressed in a simple percentage format. For example, under the current applied tariff rates a tennis racket has a tariff of 4.7%, therefore, when imported into the UK, 4.7% of the total customs value of the tennis racket is owed in customs duties. These tariffs are known as 'Ad- Valorem'.

What are the three examples of tariffs

Types of Tariffs

- Ad valorem Tariff: It is imposed as a percentage of the total value of goods purchased from a foreign country.

- Specific Tariffs: It is levied as a particular dollar amount on the number of units purchased from a foreign nation.

- Compound Tariffs: It is a blend of ad valorem and specific taxes.

To begin, understand that a tariff is a tax or fee imposed on imported goods. The best example of a tariff is a $1000-per-car fee imposed on all small cars imported. This is because a tariff is a tax or fee imposed on imported goods, and in this case, it specifically targets small cars that are imported.

What is the most common type of tariff

The most common is an ad valorem tariff, which means that the customs duty is calculated as a percentage of the value of the product. Many countries' tariff schedules also include a variety of non ad valorem tariffs.

Visualize three types of tariff viz. Most Favored Nation (MFN), Bound Tariff (BND) and Effectively Applied (AHS). Also explore Bound overhang for various countries.

What is the most common tariff used today

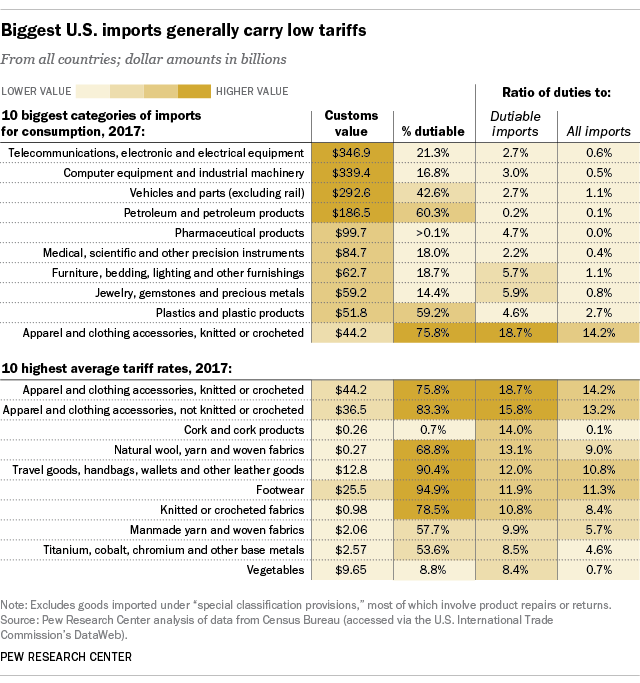

The most common kind of tariffs are ad valorem, which are levied as a fixed percentage of the value of the imports.An export tariff is put on goods being sent abroad. The import tariff and the export tariff are often different values. For instance, the import tariff on steel might be 5%, but the export tariff might be 2%. The import tariff is usually higher to protect domestic businesses.Other examples of recent tariffs include the 2002 steel tariff, which affected imported steel and was lifted in 2003; the Chinese tire tariffs, which imparted tariffs on $200 billion in goods imported from China, including a 25% tariff on tires and related materials.

The United States currently has a trade-weighted average import tariff rate of 2.0 percent on industrial goods. One-half of all industrial goods imports enter the United States duty free.

Do imports have tariffsThe United States currently has a trade-weighted average import tariff rate of 2.0 percent on industrial goods. One-half of all industrial goods imports enter the United States duty free.

Is Nafta an example of a tariffThe North American Free Trade Agreement was implemented in 1994 to encourage trade between the U.S., Mexico, and Canada. NAFTA reduced or eliminated tariffs on imports and exports between the three participating countries, creating a huge free-trade zone.

What are the different types of tariffs

There are four principal types of tariffs applicable – specific tariffs, compound tariffs, ad valorem (according to the value), and tariff-rate quota. Here is a brief description of these types: Specific tariffs: A specific tariff is levied on a product irrespective of its value.

Key Takeaways. Import duty is also known as customs duty, tariff, import tax or import tariff. Import duty is levied when imported goods first enter the country.Examples of tariff barriers include Export duties, Specific duties, Import duties, Ad – valorem duties, Transit duties, Compound duties, Revenue tariffs, Protective tariffs, Counter – vailing and Antidumping duties, Single – column tariff, Double – column tariff.The North American Free Trade Agreement was implemented in 1994 to encourage trade between the U.S., Mexico, and Canada. NAFTA reduced or eliminated tariffs on imports and exports between the three participating countries, creating a huge free-trade zone.