ニュース How much is anti-dumping duty calculated?. トピックに関する記事 – How do you calculate anti-dumping duty for import

Anti-dumping duty = Normal Value – Export Value

The normal value of the good is the domestic market value of a particular product. However, if the product does not exist in the domestic market, the Government uses the prices of any similar product available in the local market.The duty is priced in an amount that equals the difference between the normal costs of the products in the importing country and the market value of similar goods in the exporting country or other countries that produce similar products.The normal value is generally the price of the product at issue, in the ordinary course of trade, when destined for consumption in the exporting country market. In certain circumstances, for example when there are no sales in the domestic market, it may not be possible to determine normal value on this basis.

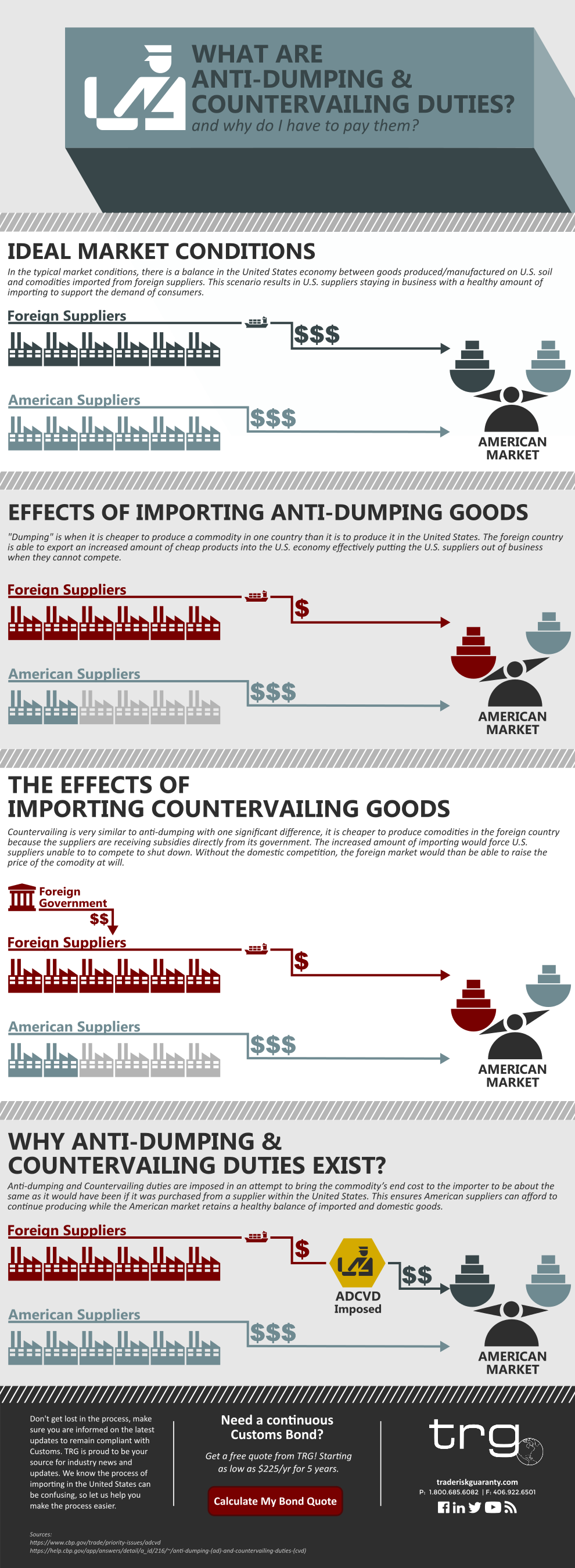

What is anti-dumping priceAnti-dumping duties are typically levied when a foreign company is selling an item significantly below the price at which it is being produced. While the intention of anti-dumping duties is to save domestic jobs, these tariffs can also lead to higher prices for domestic consumers.

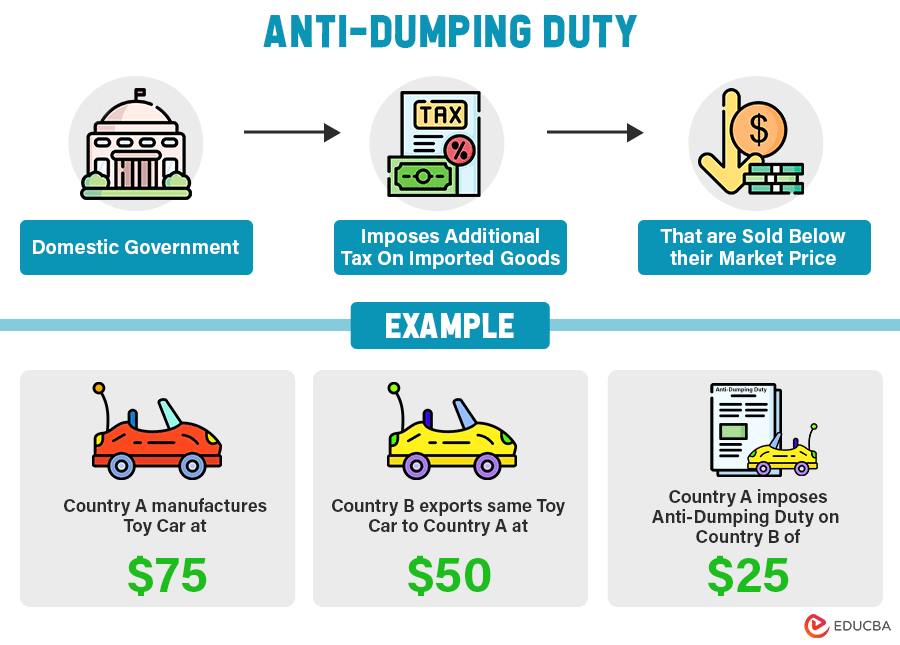

What is anti-dumping duty with example

Anti-dumping actions. If a company exports a product at a price lower than the price it normally charges on its own home market, it is said to be “dumping” the product. Is this unfair competition Opinions differ, but many governments take action against dumping in order to defend their domestic industries.Anti-dumping measures are unilateral remedies (the imposition of anti-dumping duties on the product in question) that the government of the importing country may apply after a thorough investigation has determined that the product is, in fact, being dumped, and that sales of the dumped product are causing material …

What is the anti-dumping margin

Anti-dumping investigations are to end immediately in cases where the authorities determine that the margin of dumping is insignificantly small (defined as less than 2% of the export price of the product).

An anti-dumping duty is a higher tax added to certain products to allow the government to control and monitor the introduction of them into the market. For example, a normal duty rating could be 3% – but an anti-dumping duty may be 37%. Anti-dumping tax is usually used on suspiciously cheap products.

What is the rule 5 of anti-dumping rules

(5) The designated authority shall also provide opportunity to the industrial users of the article under investigation, and to representative consumer organisations in cases where the article is commonly sold at the retail level, to furnish information which is relevant to the investigation regarding dumping, injury …Dumping usually involves exporting large quantities or offloading a product on a foreign market. For example, if UK businesses started selling apples to the US for less than what they're worth in the US, then US apple producers would have a hard time selling their products to the domestic market.The export of toys is an example of dumping. When China manufactures many toys, it exports them to other countries where it sells them at below-market prices.

The margin of dumping, if any, for goods from a particular exporter is the amount determined by subtracting the weighted average export price of the goods from the weighted average normal value of the goods.

What is anti-dumping duty measuresAnti-dumping measures can be put on imports of specific products if the Commission's anti-dumping investigation justifies it. These measures are usually in the form of an 'ad valorem' duty. Other measures that can be applied include a fixed or specific amount of duty or, in some cases, a minimum import price.

Who will pay anti-dumping dutyAnti dumping and anti subsidy duties are levied against exporter / country inasmuch as they are country specific and exporter specific as against the customs duties which are general and universally applicable to all imports irrespective of the country of origin and the exporter.

Who is responsible for anti-dumping duty

the U.S. Customs Service

If the USITC determination is affirmative, the Secretary of Commerce issues an antidumping order (in a dumping investigation) or a countervailing duty order (in a subsidy investigation), which is enforced by the U.S. Customs Service.

Anti dumping is a measure to rectify the situation arising out of the dumping of goods and its trade distortive effect. Thus, the purpose of anti dumping duty is to rectify the trade distortive effect of dumping and re-establish fair trade.Anti-dumping measures can be put on imports of specific products if the Commission's anti-dumping investigation justifies it. These measures are usually in the form of an 'ad valorem' duty. Other measures that can be applied include a fixed or specific amount of duty or, in some cases, a minimum import price.An article shall be considered as being dumped if it is exported from a country or territory to India at a price less than its normal value and in such circumstances the designated authority shall determine the normal value, export price and the margin of dumping taking into account, inter alia, the principles laid …