ニュース How much customs will I pay in USA?. トピックに関する記事 – How much is the customs duty in USA

about 5.63 percent

Duty rates vary from 0 to 37.5 percent, with a typical duty rate about 5.63 percent. Some goods are not subject to duty (e.g. some electronic products, or original paintings and antiques over 100 years old). The United States has signed Free Trade Agreements (FTAs) with a number of countries.Since the beginning of 2019, certain goods imported from Japan benefit from an exception or a reduction of applicable TARIFF (customs duty). Details are complicated and those new measures will be gradually released over a period of 7 years, but it doesn't change much for you. Most of our goods are taxed at about 3%.If merchandise, used or new, is imported into the United States, it must clear CBP and may be subject to the payment of duty as well as to whatever rules and regulations govern the importation of that particular product into the United States.

How much is import duty into USAThe import tariffs vary between 0% and 37.5 %, with 5.63% being the average. E-commerce purchases exceeding USD 2,500 will have a flat tariff rate of 3%. Textiles are the only exception. Duty will be incurred for goods in this category valued above USD 250.

Do I have to pay import duty from Japan

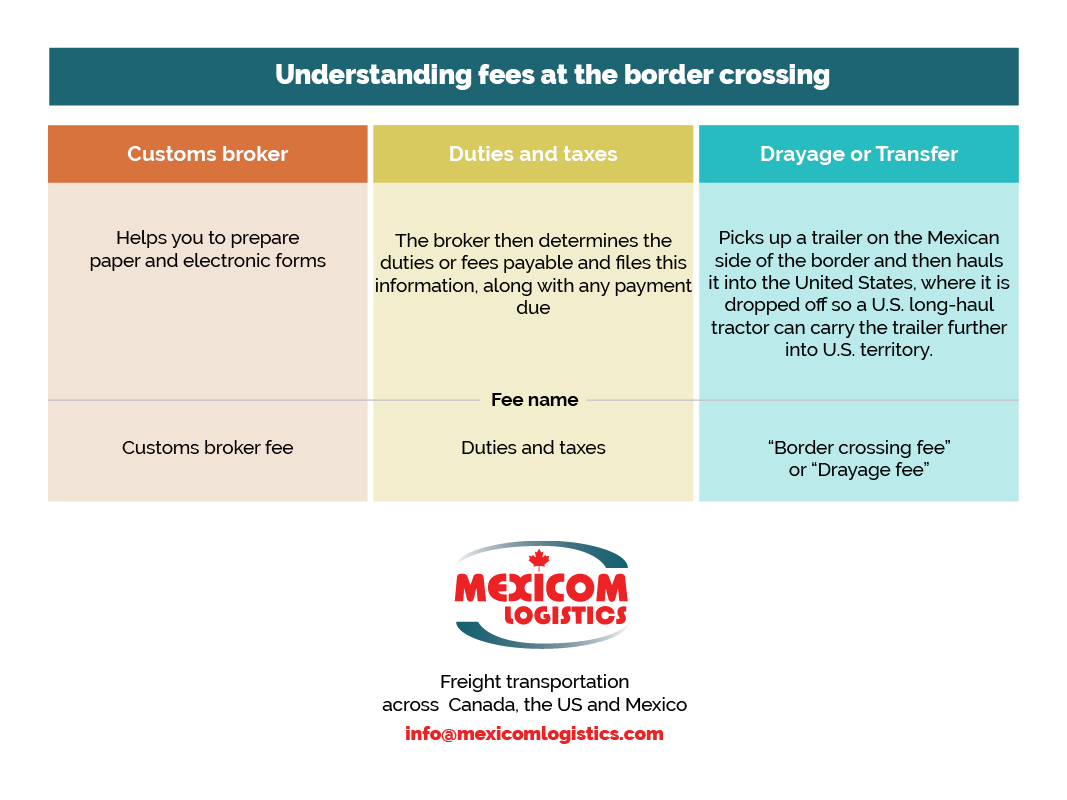

If you need to pay import duty on goods from Japan, you'll be contacted by Royal Mail (or your courier) and told how to pay. You'll usually have 3 weeks to pay any charges, before they send parcel back. As your parcel will be from outside the EU, you may be charged VAT or excise duty on it.The customs broker or customs clearance agent charges a custom clearance fee to cater to the expenses of preparing and filing customs documents. Fees are payable as one price for a bundle of services, as a flat per piece, or as a percentage of the shipment value.

Do I have to pay customs for a package from Japan to USA

Depending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.

![]()

If you need to pay import duty on goods from Japan, you'll be contacted by Royal Mail (or your courier) and told how to pay. You'll usually have 3 weeks to pay any charges, before they send parcel back. As your parcel will be from outside the EU, you may be charged VAT or excise duty on it.

Do I have to pay customs for package from Japan to us

Depending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.There isn't a specific fee for going through customs in the United States. However, certain costs may be associated with processes like obtaining visas or participating in trusted traveler programs such as Global Entry. These programs can expedite the customs process but often come with application fees.Import quotas control the amount or volume of various commodities that can be imported into the United States during a specified period of time. Quotas are established by legislation, Presidential Proclamations or Executive Orders.

Get information for E-payment Services website provides service to calculate the custom duty that will be charged on the basis of item description provided by user. It provides easy interface enter item description and finally provides custom duty as output.

Do I have to pay duty on items shipped to USAThus, any articles imported under this section for personal use with a value of under $800 can be imported duty free, and any articles imported for personal use with a value between $800 and $1800, will be subject to a flat 4% duty rate.

What needs to be declared at customs in JapanThe sealed declaration must be presented at the time of clearance of the unaccompanied articles. As regulated by laws and regulations concerned, you are required to declare all the articles that you have purchased abroad or in departures/arrivals duty-free shops in Japan and are bringing into Japan.

What is the basic of custom clearance

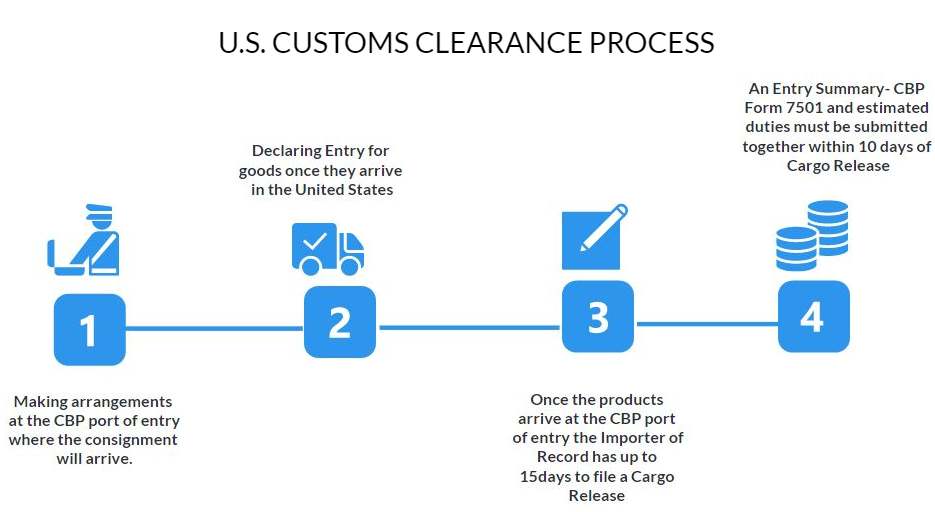

What Is Customs Clearance Customs clearance is the process of declaring goods to Customs authorities when entering or leaving a country. Individuals or businesses can do this. Goods subject to customs clearance include items that are being imported or exported, as well as personal effects and commercial shipments.

You will need to complete a customs declaration (CN22 or CN23) for any gifts and goods sent abroad.Types of Goods and to Declare in US Custom Declaration Form

- Personal Belongings and Clothing.

- Electronics and Gadgets.

- Jewelry and Valuable Items.

- Gifts and Souvenirs.

- Alcohol and Tobacco Products.

- Food Items.

- Medications.

- Currency and Monetary Instruments.

200,000yen

One ounce is about 28ml. 200,000yen. Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles.There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.