ニュース How much can you import to us without paying duty?. トピックに関する記事 – How much can I import without paying duty in USA

Do I have to pay duty on items shipped to the US Yes. Any goods valued over $800 USD (de minimis value) are subject to import duty tax. However, items valued below $800 are exempt from duty, unless they fall under the De Minimis exception list.Thus, any articles imported under this section for personal use with a value of under $800 can be imported duty free, and any articles imported for personal use with a value between $800 and $1800, will be subject to a flat 4% duty rate.Simple average applied Most Favored Nation (MFN) tariff for Japan, according to the WTO data, is as follows: All products — 4.3 percent. Agriculture products — 15.5 percent. Non-agriculture — 2.5 percent.

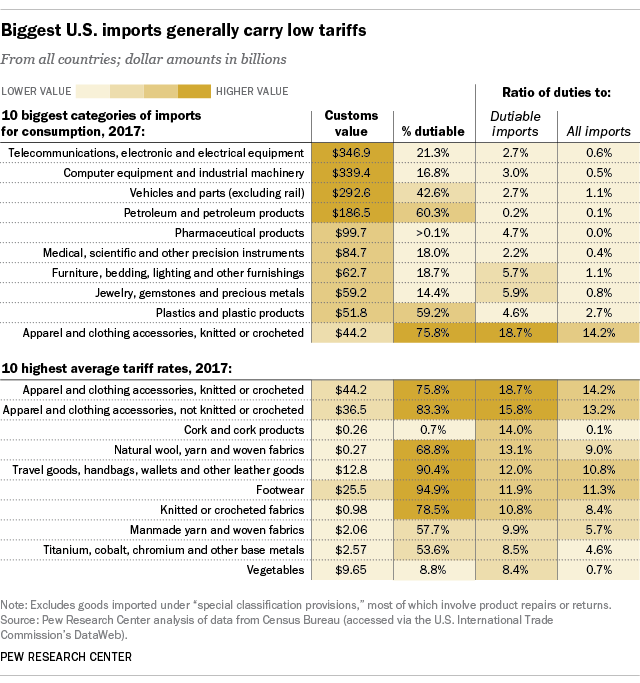

How much tax do I pay to import goods to USADuty rates vary from 0 to 37.5 percent, with a typical duty rate about 5.63 percent.

Do I have to pay customs for package from Japan to us

Depending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.Each person can return to the U.S. with up to $800 tax & duty free including alcohol and tobacco. They may also purchase in excess of their allowance which U.S. Customs may ask them to pay a small amount of tax & duty on.

Which goods are exempted from customs duty in USA

You may import furniture, dishes, linens, libraries, artwork and similar household furnishings for your personal use free of duty. To be eligible for duty-free exemption, the articles must have either been available for your use, or used in a household where you were a resident for one year.

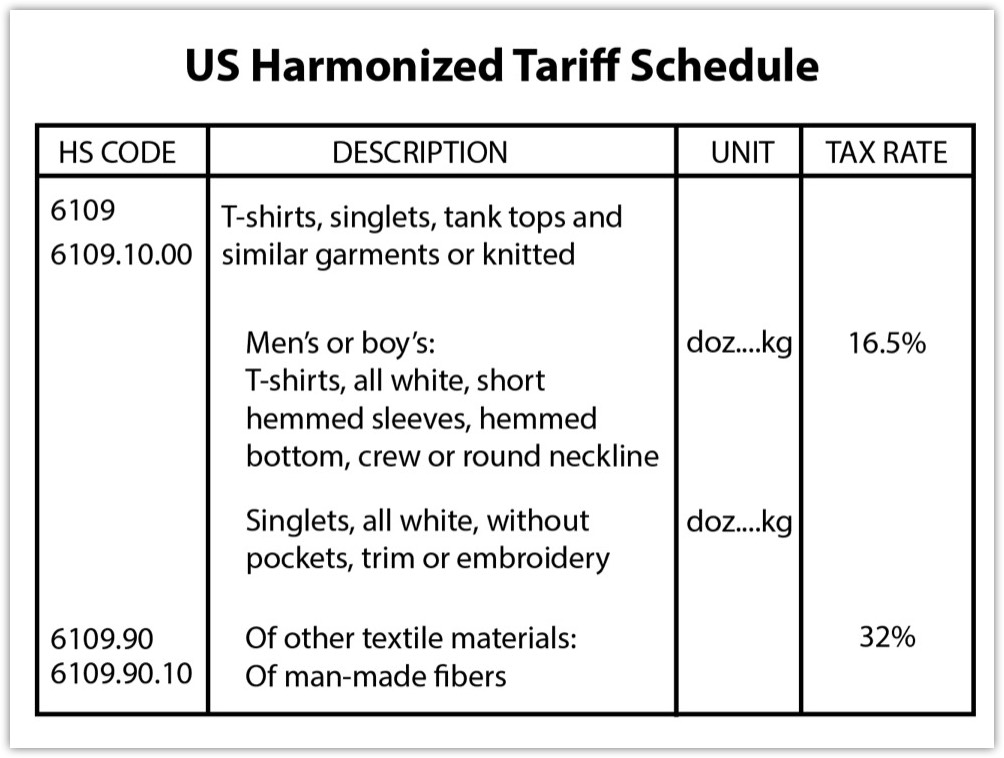

Depending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.

Do I have to pay import duty from Japan

If you need to pay import duty on goods from Japan, you'll be contacted by Royal Mail (or your courier) and told how to pay. You'll usually have 3 weeks to pay any charges, before they send parcel back. As your parcel will be from outside the EU, you may be charged VAT or excise duty on it.Types of Goods and to Declare in US Custom Declaration Form

- Personal Belongings and Clothing.

- Electronics and Gadgets.

- Jewelry and Valuable Items.

- Gifts and Souvenirs.

- Alcohol and Tobacco Products.

- Food Items.

- Medications.

- Currency and Monetary Instruments.

To calculate the estimated duty fee for a shipment where the fee is determined by percentage value, simply multiply the total value of the goods by the percentage that applies to their HTS code, and then divide this figure by 100.

200,000yen

One ounce is about 28ml. 200,000yen. Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles.There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.

What is duty-free in the USDuty-free shopping is being able to purchase items without paying import, sales, value-added, or other taxes. For many travelers, it's an enticing perk of frequent international travel.

How much jewelry can you bring into the USCan you bring jewelry on a plane While you can bring your valuables into the country without issue, you do have to declare everything – and any item over $10,000 will require a different form than normal. And if you're carrying anything more expensive than that in your bags, it's a good idea to make sure it's insured.

What items need to be declared at customs

Remember to declare all goods you bring into the United States, including gifts and souvenirs. Even if an item is intended for someone else or has sentimental value, it must be declared. A detailed description and estimated value for each item will facilitate the customs process.

The U.S. International Trade Commission-Tariff Database, is an interactive data base that will enable you to get an approximate idea of the duty rate for a particular product. Please be aware that the duty rate you request is only as good as the information you provide.Customs selects the duty-free items in the travelers' favor and then imposes duties on the rest. There is no duty-free allowance for articles worth more than ¥200,000 each, for example, a bag worth ¥250,000, the duty will be imposed on the entire sum of ¥250,000.Japan Import Tax & Custom Fees

There are usually also charges levied by the import customs broker for filing the import customs clearance documents with the local customs authorities. This customs brokerage fee will be in addition to the customs duties and import VAT / GST applied to the imported goods.