ニュース How much are import tariffs in the US?. トピックに関する記事 – What is the import tariff rate in the US

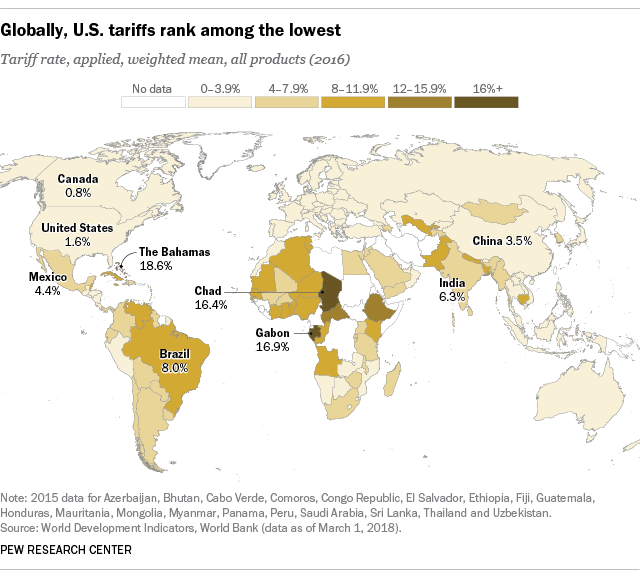

The United States currently has a trade-weighted average import tariff rate of 2.0 percent on industrial goods. One-half of all industrial goods imports enter the United States duty free.The Total Cost of U.S. Tariffs

| Tariff | Value of Affected U.S. Imports (2022) | Tariff Rate |

|---|---|---|

| Section 301, List 3 | $118.5 B | 25% |

| Section 301, List 4A | $102.1 B | 7.5% |

| Section 301, List 4B | $147.1 B | Suspended |

| Total[6] | $277.5 B | 7.5 – 25% |

U.S. tariff rates for 2020 was 1.52%, a 12.26% decline from 2019. U.S. tariff rates for 2019 was 13.78%, a 12.19% increase from 2018.

What is tariff rateA tariff is a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages.

How do I import goods to USA

- Step 1: Obtain an Importer Number.

- Step 2: Speak to a Customs Broker.

- Step 3: Determine your goods' Tariff Classification and Valuation.

- Step 4: Prepare your Commercial Invoice.

- Step 5: Complete your Importer Security Filing (only for ocean shipments)

- Step 6: Determine if you will need a Customs Bond.

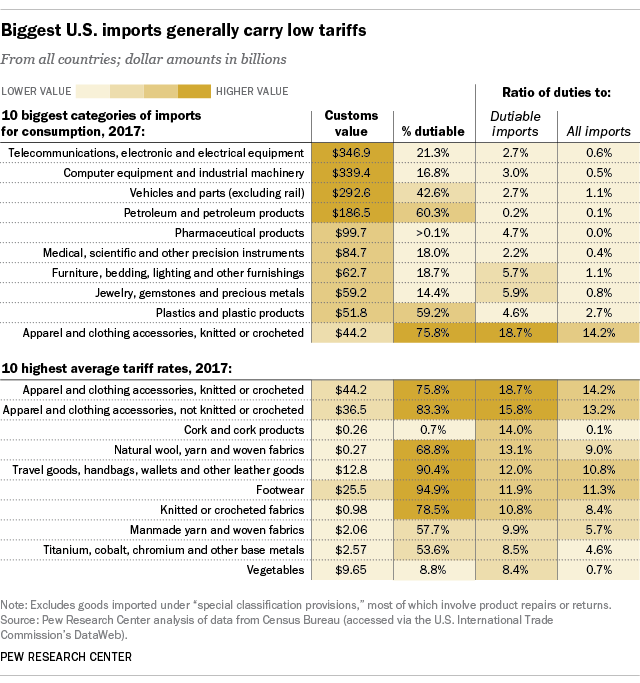

The average tariffs on the dutiable portions were 18.7% for knitted or crocheted clothing, and 15.8% for non-knitted or crocheted items – the two highest average rates out of 98 broad import categories.

How do tariffs work in the US

A tariff is a type of tax levied by a country on an imported good at the border. Tariffs have historically been a tool for governments to collect revenues, but they are also a way for governments to try to protect domestic producers. As a protectionist tool, a tariff increases the prices of imports.

But more than two years into his term, President Biden has kept the tariffs. They are under review, but experts say there is little political room for him to get rid of them altogether.

Which country has the highest import tax

With the prospect of increased tariffs looming, World Finance lists the countries that impose the highest charges on imported goods.

- 1 – The Bahamas (18.56%)

- 2 – Gabon (16.93%)

- 3 – Chad (16.36%)

- 4 – Bermuda (15.39%)

- 5 – Central African Republic (14.51%)

For example: For clothes coming in from China with FOB prices above $5,000 per piece, there will be a 27 percent customs duty levied if they are for commercial use. If you import them for personal use only, you will be charged 2.9 percent.Add up the goods' value, freight costs, insurance, and any additional costs, and multiply the total by the duty rate. The result is the amount of duty you'll need to pay Customs for your shipment.

The simple way to calculate a trade-weighted average tariff rate is to divide the total tariff revenue by the total value of imports. Since these data are regularly reported by many countries, this is a common way to report average tariffs.

What can you not import into the USWild birds, land or marine mammals, reptiles, fish, shellfish, mollusks or invertebrates; Any part or product of the above, such as skins, tusks, bone, feathers, or eggs; or. Products or articles manufactured from wildlife or fish.

How do I legally importThe steps involved in importing goods to India:

- Obtain Import-Export Code (IEC):

- Ensure the legal compliance under different trade laws:

- Procure Import Licenses.

- File Bill of Entry and other documents to complete customs clearing formalities:

- Determine import duty for the clearance of goods:

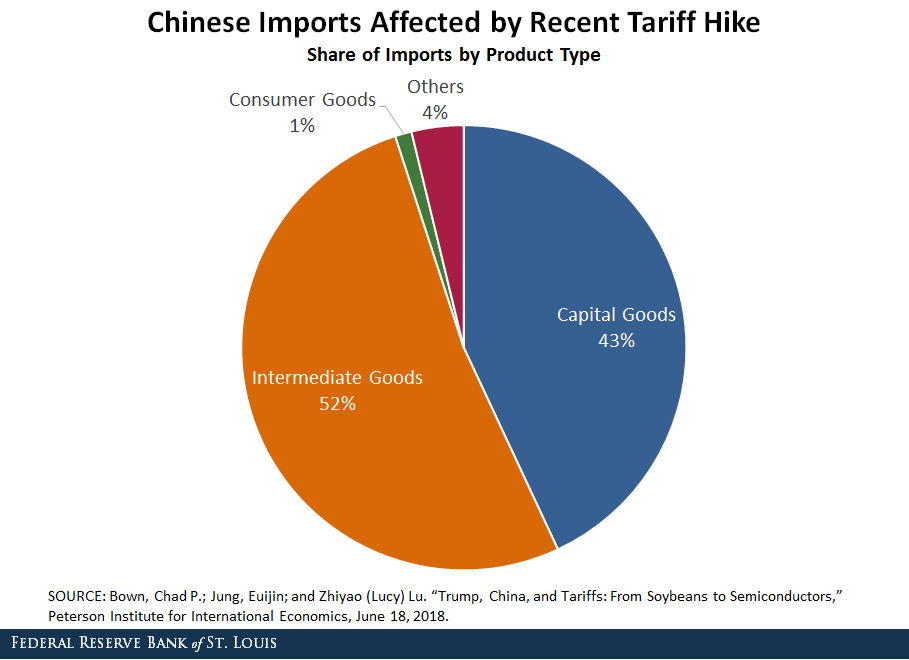

How much did Trump’s tariffs cost

Key Findings. The Trump administration imposed nearly $80 billion worth of new taxes on Americans by levying tariffs on thousands of products valued at approximately $380 billion in 2018 and 2019, amounting to one of the largest tax. increases in decades.

Now for more context, U.S. tariffs by product:

Average U.S. tariff for all imported goods: 1.4 to 1.6 percent. Lowest tariffs:0 percent. Some 54 percent of all imported goods face no tariff. Highest tariffs: 8.5 to 67.2 percent for clothing and shoes.However, if a foreign country levied a tariff on certain U.S. exports, this could result in a decline in the number of exports consumed by the foreign country, as they would become more expensive.The United States is the world's largest importer of goods, followed by China and Germany. Overall out of the world's 10 largest importers, 4 countries are in Europe, 4 are in Asia and 1 from North America and 1 from Central America. NO.