ニュース How do you calculate total duty?. トピックに関する記事 – What is the standard deduction for Japan

A permanent and/or non-permanent resident employee can take an earned income deduction, computed by applying an appropriate rate to gross employment income as follows (the minimum standard deduction is JPY 550,000 or gross employment income, whichever is lower).If a corporation meets certain conditions, such as keeping certain accounting books, and makes an application for it in advance, it is allowed to file a 'blue form' tax return. A 'blue form' filing corporation may benefit from loss carryforward and other benefits, including access to incentives.Blue return filers who are engaged in business that generates real estate income or business income shall, in principle, receive a deduction of up to 550,000 yen(blue return filers who keep book by electronic book keeping of who has filed the final tax return by e-Tax receive a deduction up to 650,000 yen) through such …

What is the amount of employment incomeThe amount of employment income is calculated by subtracting the amount of deduction for employment income from the gross amount of salaries and wages.

How is the consumption tax calculated in Japan

Consumption tax

The general rate is 10%; however, a lower rate of 8% applies to food and beverages (excluding when purchased in restaurants and alcoholic beverages) and to newspaper subscriptions that meet certain criteria. Exports and certain services to non-residents are taxed at a zero rate.20.42%

Non-residents

A non-resident taxpayer's Japan-source compensation (employment income) is subject to a flat 20.42% national income tax on gross compensation with no deductions available. This rate includes 2.1% of the surtax described above (20% × 102.1% = 20.42%).

What is the highest tax in Japan

The statistic shows the highest tax rate in Japan from 2011 to 2021. In 2021, the highest tax rate in Japan was 55.97 percent.

If you open the bag and use the item(s), you will be required pay taxes at customs. ・Prior to departure, please show the customs officer the tax free item(s) purchased as well as the "Record of Purchase of Consumption Tax-Exempt for Export Slip" attached to your passport.

How much is tax free in Japan for foreigners

¥5,000

For details, please check the Japan Tourism Agency website. Specially packaged consumable tax-free products must not be opened until you have left the country. Tax free purchases apply to total purchase amounts of ¥5,000 or more (excluding tax/after discount has been applied), or¥5,500 (including tax).To calculate an employment rate, divide the number of people employed by the number of people in the labor force.National Income (Y) can be calculated by measuring the total level of output of the economy (GDP etc). Generally speaking, the more the economy produces, the more people (Labour) will be needed to produce extra goods and services.

The tax exemption system (Tax Free Shopping) only applies to foreign tourists visiting Japan. To qualify your stay in Japan has to be less than 6 months and you cannot currently work in Japan (non-resident). Japanese who live abroad and are staying in Japan for less than 6 months can also enjoy tax-free shopping.

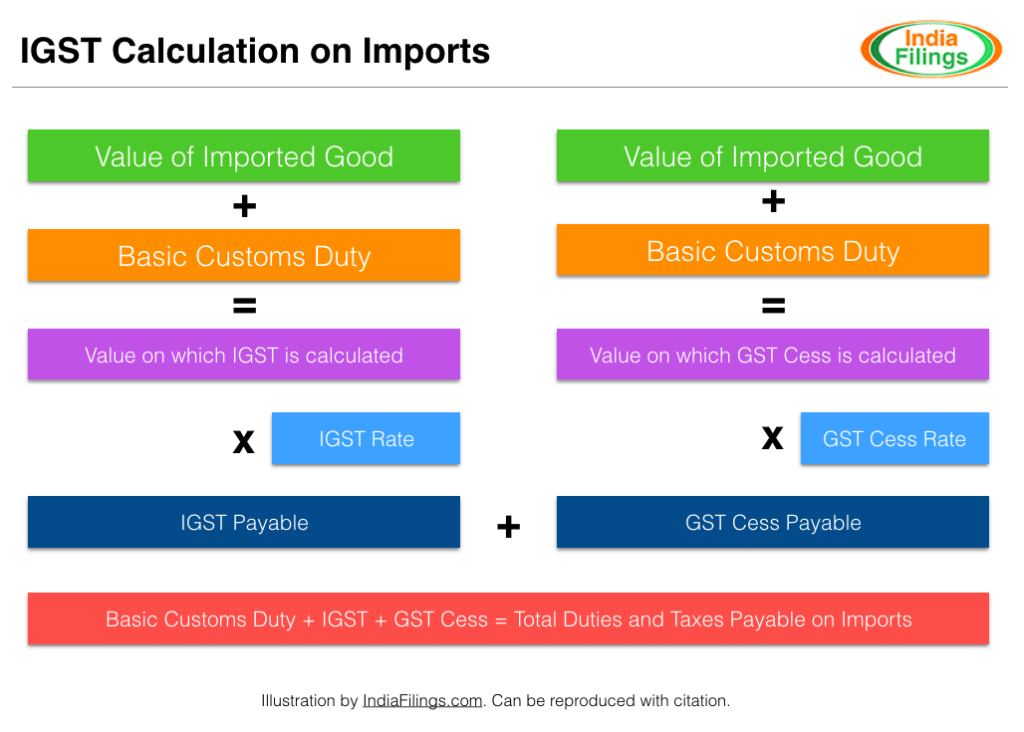

What is customs consumption tax in Japan10%

For general inquiries about these sections, please contact Customs Counselors. Consumption tax is imposed at the rate of 10% (standard tax rate) or 8% (reduced tax rate) on, in general, all goods imported into or manufactured in Japan.

What happens if you don’t pay taxes in JapanFailure to pay will result in late penalties. In some cases, your assets could be seized to pay for outstanding taxes. The late penalty is calculated from the day after the due date.

Do non citizens pay taxes in Japan

Non-residents

A non-resident taxpayer's Japan-source compensation (employment income) is subject to a flat 20.42% national income tax on gross compensation with no deductions available. This rate includes 2.1% of the surtax described above (20% × 102.1% = 20.42%).

Japan's 2021 tax-to-GDP ratio ranked it 20th¹ out of 38 OECD countries in terms of the tax-to-GDP ratio compared with the 2022 figures. In 2021 Japan had a tax-to-GDP ratio of 34.1%, compared with the OECD average of 34.0% in 2022 and 34.2% in 2021.Customs inspect your possession of the tax-free goods as necessary. If you DO NOT EXPORT the tax-free goods, you have to pay the consumption tax at customs. You may be subject to penalty (Imprisonment up to 1 year or a fine up to maximum of 500,000 yen) if you have transferred the tax-free goods prior to departure.Customs inspect your possession of the tax-free goods.

If you DO NOT POSSESS the tax-free goods upon departure, you have to pay the consumption tax at customs.