ニュース How do I get customs duty exemption?. トピックに関する記事 – Which goods are exempted from customs duty in India

A few products, such as vital medicines and equipment, fertilizers, food grains, etc., are exempt from import taxes.Goods ordered from a retailer in a foreign country are only exempt from customs duty if they are worth £135 or less and do not contain alcohol or tobacco. These limits also apply to gifts. Travellers bringing in goods within their £390 personal allowance are also exempt from paying VAT.ALLOWANCE WHEN YOU ARE ARRIVING TO INDIA :

- 100 cigarettes or 25 cigars or 125g of tobacco.

- 2 liter of alcoholic liquor or wine.

- Total Value Duty Free Purchases cannot exceed Rs 50,000.

Which goods are exempted from Customs duty in USAHousehold Effects & Personal Effects – Customs Duty Guidance

Household effects conditionally included are duty-free. These include such items as furniture, carpets, paintings, tableware, stereos, linens, and similar household furnishings; tools of the trade, professional books, implements, and instruments.

What is duty exempted Customs

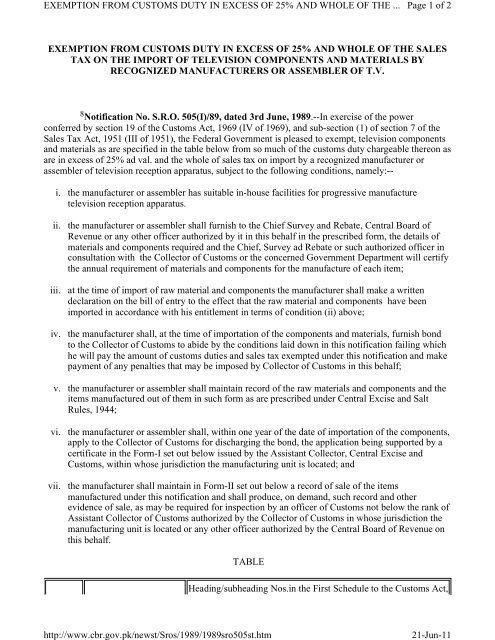

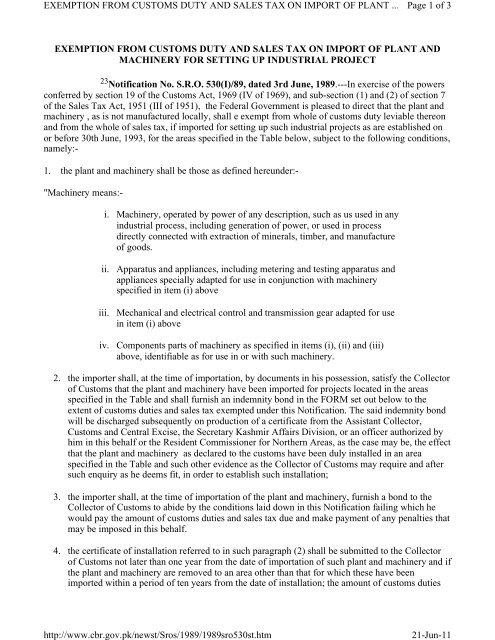

Exemption to goods from Customs duty only when imported against an Advance Licence (without Actual user condition) – Notification No. 107/95-Cus dated 2.6.1995. 12. Exemption to inputs for leather and textile garments when imported against a Value Based Advance Licence issued on or after 19.9.1995 – Notification No.There's no limit, however, to how much foreign currency you can bring into India. Although, you will have to declare it if the amount exceeds US$5,000 in notes and coins, or US$10,000 in notes, coins, and traveller's cheques².

Do I need to declare duty free items India

Only passengers who are carrying dutiable or prohibited goods are required to fill a Customs Declaration Form or use ATITHI mobile app to file declaration of dutiable items as well as currency with Indian Customs even before boarding the flight to India.

Also, anything you bring back that you did not have when you left the United States must be "declared." For example, you would declare alterations made in a foreign country to a suit you already owned, and any gifts you acquired outside the United States.

Which goods are exempted from customs duty in USA

Household Effects & Personal Effects – Customs Duty Guidance

Household effects conditionally included are duty-free. These include such items as furniture, carpets, paintings, tableware, stereos, linens, and similar household furnishings; tools of the trade, professional books, implements, and instruments.There's no limit, however, to how much foreign currency you can bring into India. Although, you will have to declare it if the amount exceeds US$5,000 in notes and coins, or US$10,000 in notes, coins, and traveller's cheques².Checked Luggage

This typically corresponds to 27 inches (68cm) x 21 inches (53cm) x 14 inches (35cm). The international flight baggage weight limit averages 50 pounds (23kg), but some airlines allow up to 70 pounds (32kg) for their business-class and first-class passengers.

Personal Use:You can bring up to two phones without incurring any customs duty. This means you can carry two phones for your personal use without paying any additional fees. If you are carrying more than two phones, you will likely need to declare them at customs and may be subject to paying customs duty.

What items need to be declared at customsRemember to declare all goods you bring into the United States, including gifts and souvenirs. Even if an item is intended for someone else or has sentimental value, it must be declared. A detailed description and estimated value for each item will facilitate the customs process.

What happens if you don’t declare at customsThe criminal fine is up to $500,000 or twice the value of the contraband non-declared products, whichever is greater. The fines don't stop there. In additional to the criminal penalty, there is a civil penalty of up to $10,000, or the value of the contraband non-declared product, whichever is greater.

How much is customs duty in USA

Duty rates vary from 0 to 37.5 percent, with a typical duty rate about 5.63 percent. Some goods are not subject to duty (e.g. some electronic products, or original paintings and antiques over 100 years old). The United States has signed Free Trade Agreements (FTAs) with a number of countries.

exceed US $10,000/- or its equivalent and/ or the value of foreign currency exceeds US $5,000/- in currency notes or its equivalent, it should be declared to the Customs Authorities at the Airport in the Currency Declaration Form, on arrival in India.ALLOWANCE WHEN YOU ARE ARRIVING TO INDIA :

100 cigarettes or 25 cigars or 125g of tobacco. 2 liter of alcoholic liquor or wine. Total Value Duty Free Purchases cannot exceed Rs 50,000.All airlines have additional baggage fines set in place which will charge you for every kilo you have gone over the allocated weight.