ニュース How do I check import duty in USA?. トピックに関する記事 – How is import duty calculated in USA

The Customs Duty Rate is a percentage. This percentage is determined by the total purchased value of the article(s) paid at a foreign country and not based on factors such as quality, size, or weight. The Harmonized Tariff System (HTS) provides duty rates for virtually every existing item.The import tariffs vary between 0% and 37.5 %, with 5.63% being the average. E-commerce purchases exceeding USD 2,500 will have a flat tariff rate of 3%. Textiles are the only exception. Duty will be incurred for goods in this category valued above USD 250.Simple average applied Most Favored Nation (MFN) tariff for Japan, according to the WTO data, is as follows: All products — 4.3 percent. Agriculture products — 15.5 percent. Non-agriculture — 2.5 percent.

How much tax do I pay on imported goods in USADuty rates vary from 0 to 37.5 percent, with a typical duty rate about 5.63 percent. Some goods are not subject to duty (e.g. some electronic products, or original paintings and antiques over 100 years old). The United States has signed Free Trade Agreements (FTAs) with a number of countries.

How do I check my customs duty online

Get information for E-payment Services website provides service to calculate the custom duty that will be charged on the basis of item description provided by user. It provides easy interface enter item description and finally provides custom duty as output.You'll need to pay customs duty (or import tax) on any goods you move across the US border from other countries, though goods from some countries are exempt due to different international trade agreements.

Do you pay import tax in us

You'll need to pay customs duty (or import tax) on any goods you move across the US border from other countries, though goods from some countries are exempt due to different international trade agreements.

If you need to pay import duty on goods from Japan, you'll be contacted by Royal Mail (or your courier) and told how to pay. You'll usually have 3 weeks to pay any charges, before they send parcel back. As your parcel will be from outside the EU, you may be charged VAT or excise duty on it.

How much is custom clearance fee in USA

Merchandise Processing Fee (MPF)

US Customs collects this fee on most shipments that enter the country. It's calculated at 0.3464% of the entered value (the cost of the merchandise, as entered on the commercial invoice you provide to your customs broker), with a minimum of $27.23 and a maximum of $528.33.Import quotas control the amount or volume of various commodities that can be imported into the United States during a specified period of time. Quotas are established by legislation, Presidential Proclamations or Executive Orders.The U.S. is one of the few countries that does not charge VAT or GST. Instead, the U.S. uses state sales tax as its method of taxation. However, there are several criteria that need to be met in order for the sales tax representative to be able to collect sales tax.

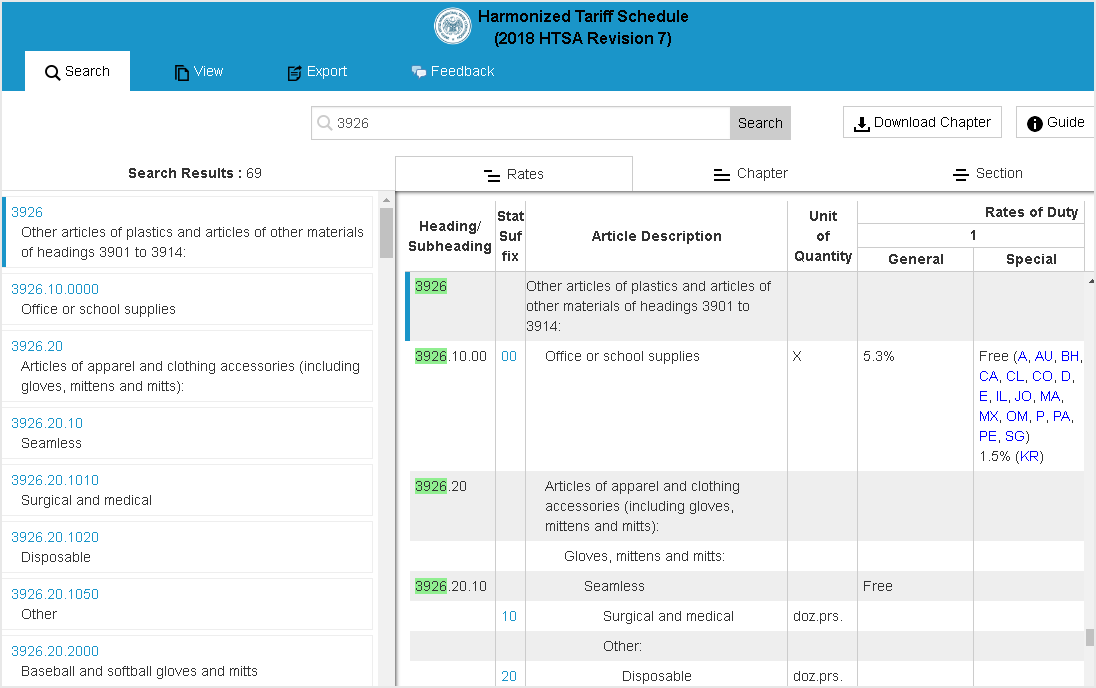

You can do this by searching for the type of goods you intend to import using the United States International Trade Commission's HTS search tool. When you have found the right HTS code for your goods, the search tool we linked to above will tell you the rate of duty payable on goods of that type.

Can I pay custom duty onlineUsers can now avail facility of e-Payment through ICEGATE for all Custom Locations from any of the following authorized Banks.

Do I have to pay customs for package from Japan to usDepending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.

Does Japan airport check duty-free

Customs inspect your possession of the tax-free goods as necessary. If you DO NOT EXPORT the tax-free goods, you have to pay the consumption tax at customs.

penalty not exceeding the duty sought to be evaded on such goods or the difference between the declared value and the value thereof or Rs. 5,000/-, whichever is the highest.You'll need to pay customs duty (or import tax) on any goods you move across the US border from other countries, though goods from some countries are exempt due to different international trade agreements.General Merchandise Entry: $175; PGA Form: $35; Import Security Filing (ISF): $55.