ニュース Do I need to pay US sales tax?. トピックに関する記事 – Do I need to charge US sales tax

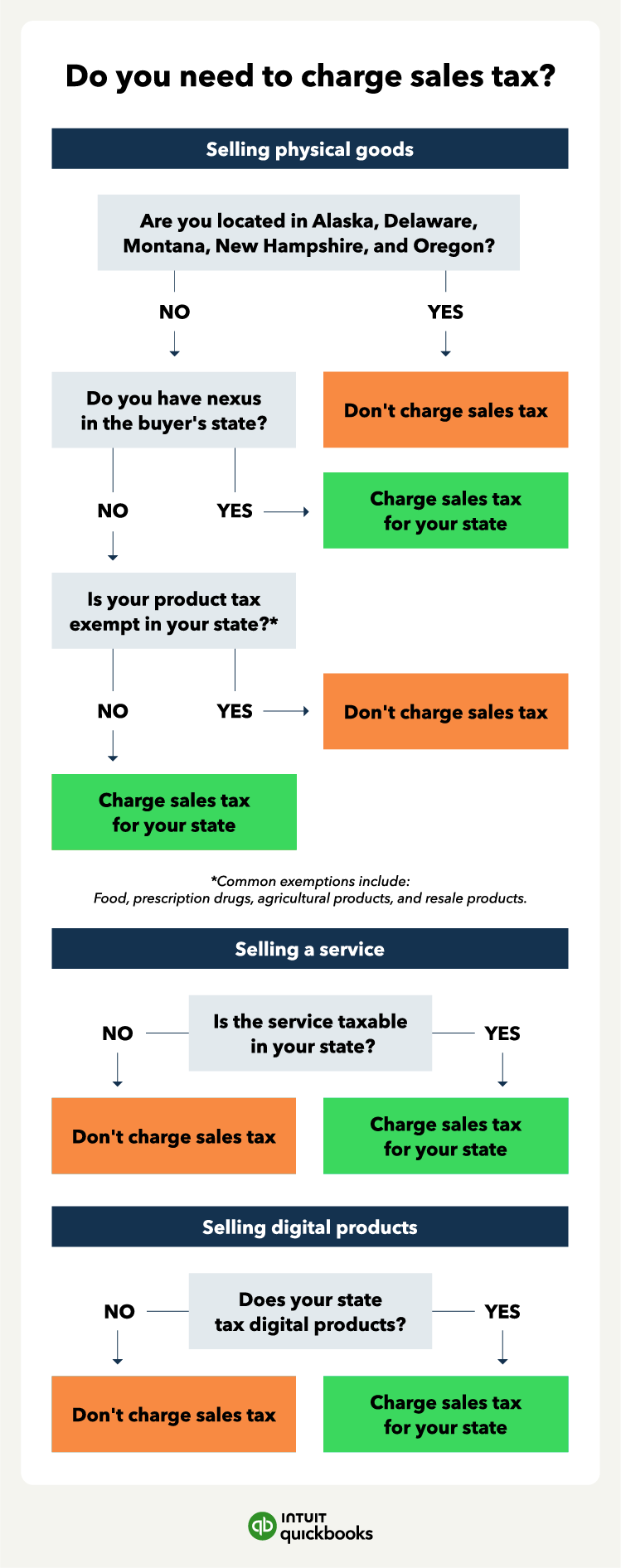

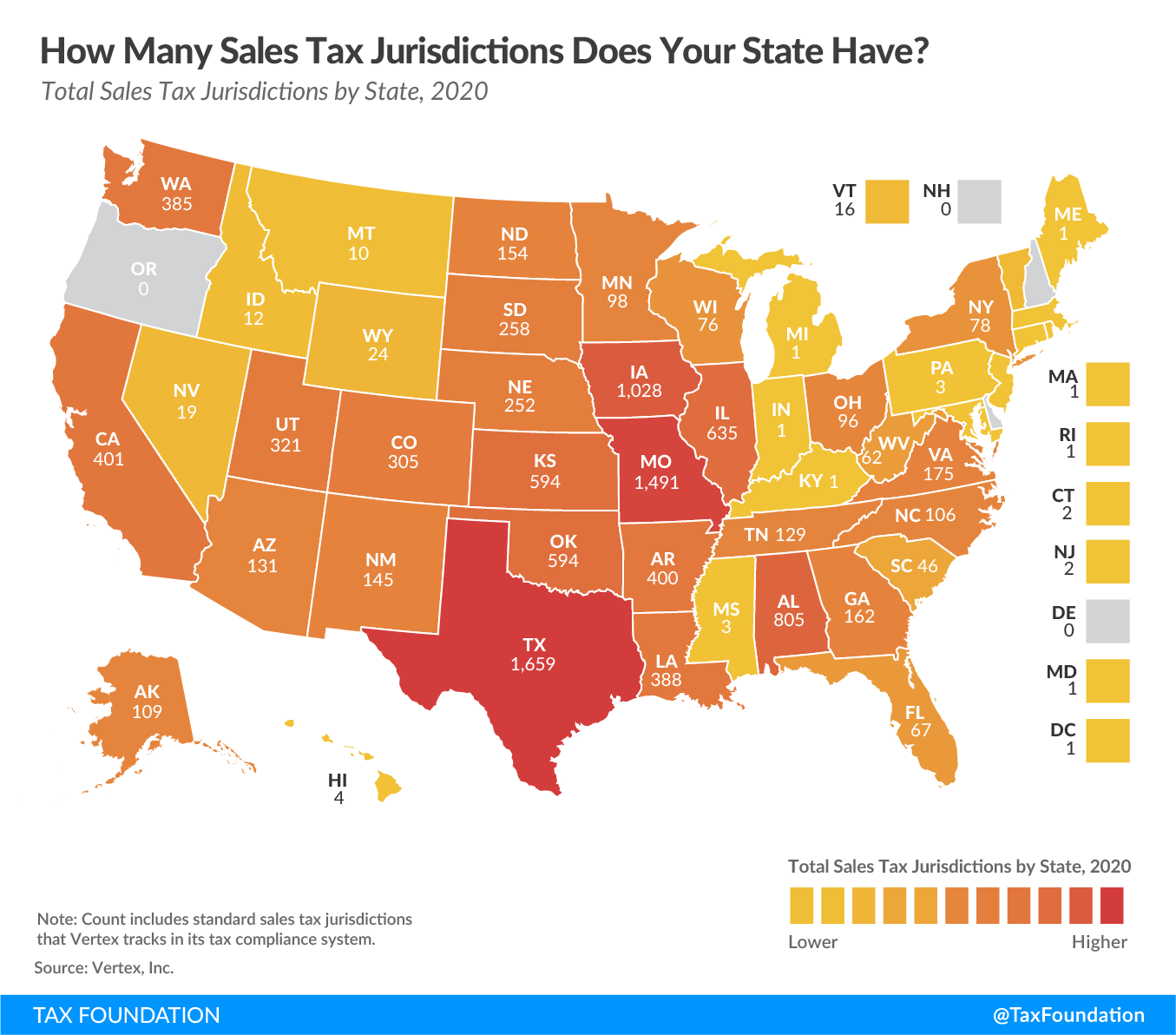

The 50 US states are broadly free to charge sales tax on businesses with a local permanent establishment, or 'nexus', in their territory. This is typically employees and/or premises within the state. Additionally, having a significant commercial tie to a state may trigger a taxable nexus.Therefore, if a non-resident visitor to the United States purchases any taxable items and takes possession of the goods at the retailer's location, sales tax is due and there is generally no refund of the sales tax paid simply because the goods will be removed from the United States.Nearly all U.S. states have their own sales tax, with the only exceptions being New Hampshire, Oregon, Montana, Arkansas and Delaware (known as NOMAD). In addition, states have authorized various local entities such as counties, cities, etc. to collect retail sales taxes.

Is the US a VAT or sales taxThe US is one of the very few countries in the world that still applies a final sales tax; most OECD countries now operate a full VAT or GST tax regime.

Who is exempt from US sales tax

Specific types of customers are exempt from paying sales tax on their purchases. Depending on the state, these may include government entities, non-profits, and schools, to name a few.Purchasers are required to pay sales tax unless they present the seller with certification that the purchase is exempt from tax (exemption certificate). The certificate must be on a form approved by the state. 38 states have approved use of the Multistate Tax Commission's Uniform Sales and Use Tax Certificate.

Can tourists claim sales tax in USA

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government – the same way that Value Added Tax (VAT) is paid in many countries.

Is there VAT in the U.S. There is no VAT in the United States. But even though the United States doesn't have a value-added tax, it does require consumers to pay federal excise taxes on the purchase of gasoline, alcohol, tobacco and other products.

How much is sales tax in USA

The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. In Texas, prescription medicine and food seeds are exempt from taxation.Tax exemptions can be availed by investing in the following tools:

- Senior Citizen Savings Scheme (SCSS)

- Sukanya Samriddhi Yojana (SSY)

- National Pension Scheme (NPS)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

It is typically a percentage of the purchase price and is added to the final cost of the product or service. The rate of sales tax varies by location, with different states and localities having their own rates. In the United States, it is not a federal tax, but rather a state and local tax.

In the U.S., sales tax is generally not refundable. It doesn't matter if you live there or not. The US government does not refund sales tax to foreign visitors. Sales tax charged in the US is paid to individual states, not the Federal government.

How do tourists get tax refund in USAThe United States Government does not refund sales tax to foreign visitors. The foreign country in which you paid the Value Added Tax (VAT) is responsible for refunding the tax.

How do I claim VAT back from USAThe United States Government does not refund sales tax to foreign visitors. The foreign country in which you paid the Value Added Tax (VAT) is responsible for refunding the tax. Some countries won't refund after the fact, so check with the Foreign Embassies & Consulates office of the country you visited. Also.

Are sales to USA outside the scope of VAT

The majority of goods exported to the US can be zero-rated for VAT. In other words, you don't need to charge VAT on the exported goods or extra charges such as shipping and delivery.

8.875 percent

The total sales and use tax rate is 8.875 percent. This includes: New York City local sales and use tax rate of 4.5 percent. New York State sales and use tax rate of 4.0 percent.States with the highest sales tax

- California: 7.25% sales tax rate.

- Indiana: 7% sales tax rate.

- Mississippi: 7% sales tax rate.

- Rhode Island 7% sales tax rate.

- Tennessee: 7% sales tax rate.

- Minnesota: 6.875% sales tax rate.

- Nevada: 6.85% sales tax rate.

- New Jersey: 6.625% sales tax rate.

Comparison of Tax Rates under New Tax Regime and Old Tax Regime for FY 2023-24 (AY 2024-25)

| Tax Slabs | Age Less than 60 years | Age More than 80 years |

|---|---|---|

| Rs. 2,50,001 to Rs. 3,00,000 | 5% (Tax rebate u/s 87A) | Nil |

| Rs. 3,00,001 to Rs. 5,00,000 | Nil | |

| Rs. 5,00,001 to Rs. 10,00,000 | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% |