ニュース Can you claim tax back from Japan?. トピックに関する記事 – How to leave Japan with tax free items

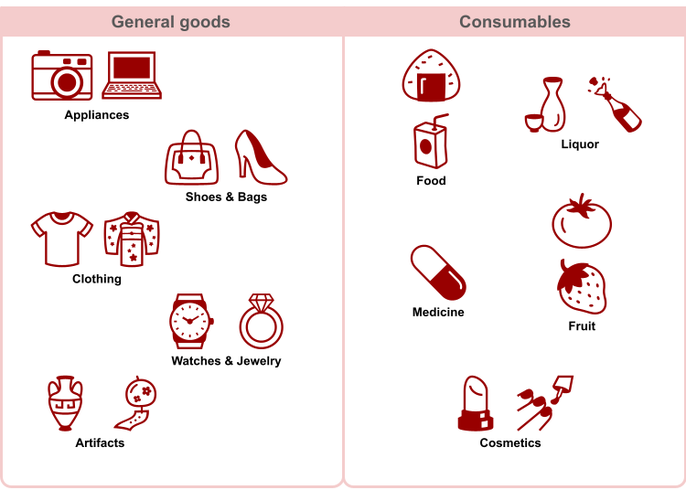

Purchase of Tax-Free Goods

You are required to export the tax-free goods. Do not transfer or consume the tax-free goods in Japan. When leaving Japan, at the airport or seaport of departure, if you do not have “Record of purchase slip”, please present your passport at customs.Tax-free shopping in Japan refers to the 10% sales/consumption tax, also known as VAT, which can be claimed by foreign travelers, or found at tax-free stores dispersed throughout Japan. More and more stores are offering tax-free items given the rise of tourists shopping in Japan.The refund will be remitted to your account at a post office or a bank. If you have not overpaid income tax due to withheld tax or the like, you cannot receive a tax refund. Income tax consultation and payments for every tax year must be done between February 16 and March 15 of the following year.

What happens if I open tax free bag in JapanIf you open the bag and use the item(s), you will be required pay taxes at customs. ・Prior to departure, please show the customs officer the tax free item(s) purchased as well as the "Record of Purchase of Consumption Tax-Exempt for Export Slip" attached to your passport.

Do you need to keep receipts for tax-free Japan

Don't forget to bring necessary items for tax-free procedure such as the purchased items and the receipt. The person who made the purchase must be identified when going through tax-free procedure There are different tax-free store signs for standard tax-free stores and one-stop tax-free procedure stores.Customs selects the duty-free items in the travelers' favor and then imposes duties on the rest. There is no duty-free allowance for articles worth more than ¥200,000 each, for example, a bag worth ¥250,000, the duty will be imposed on the entire sum of ¥250,000.

How much tax refund will I get in Japan

TAX REFUND FOR BUSINESSES & INDIVIDUALS

| Dependents | Income Tax Refundable/year | Total amount of Tax Refund/year |

|---|---|---|

| 1 dependent | ¥ 19,300 | ¥ 54,800 |

| 2 dependents | ¥ 38,600 | ¥ 109,600 |

| 3 dependents | ¥ 57,900 | ¥ 164,400 |

¥5,000

Tax free purchases apply to total purchase amounts of ¥5,000 or more (excluding tax/after discount has been applied), or¥5,500 (including tax). ・The items purchased must be put in a dedicated bag.

How do I claim my tourist tax back in Japan

When you purchase merchandise, you can pay the tax-exempt price. The tax refund procedure must be carried out while at an airport or similar location. To carry out the procedure, you must show your actual passport, not a copy of the visa page.The tax refund procedure must be carried out while at an airport or similar location. To carry out the procedure, you must show your actual passport, not a copy of the visa page. Tourists traveling by cruise ship need to show their cruise ship tourist permit.Don't forget to bring necessary items for tax-free procedure such as the purchased items and the receipt. The person who made the purchase must be identified when going through tax-free procedure There are different tax-free store signs for standard tax-free stores and one-stop tax-free procedure stores.

If you withdraw your refund as a lump sum, you'll have to pay 20% in income tax, which means you'll only get 80% of your total payment at first. The good news is that you can get the 20% tax refunded because you won't have to pay income tax in Japan anymore. To get your refund, you need to appoint a tax representative.

How much is Japan VAT refundJapan VAT Refund For Visitors

A VAT refund of up to 5.00% of your total expenditures may be refunded for qualifying purchases. Regulations on VAT and sales tax refunds vary across countries and by region, so be sure to check ahead before expecting a Japan VAT refund.

How much tax free can you get in Japan¥5,000

Tax free purchases apply to total purchase amounts of ¥5,000 or more (excluding tax/after discount has been applied), or¥5,500 (including tax). ・The items purchased must be put in a dedicated bag.

Can tourists claim VAT in Japan

As a bonus, Japan is one of around only 60 countries globally that offer tax-free shopping for tourists, meaning that foreign travelers are entitled to claim Japan's 10 percent consumption tax (also known as VAT) from many of their purchases.